City of Vancouver Business License Regulations, Mar 2024 Page 1 of 2

CITY BUSINESS LICENSE INFORMATION

Office: City Hall, 415 W 6th St, Vancouver WA 98660

Mail: PO Box 1995, Vancouver WA 98668-1995

Phone: 360-487-8410 ext 3 Fax: 360-487-8483

Email: business.licenses@cityofvancouver.us

Website: www.cityofvancouver.us/businesslicense

BUSINESS LICENSE REGULATIONS & PROCESS SUMMARIES

♦ The City of Vancouver’s business licensing regulations are set forth in Vancouver Municipal Code (VMC) Section 5.04; see:

https://vancouver.municipal.codes/VMC/5.04.

♦ T

he city’s processes to administer the business license regulations are summarized herein. For more detail, see:

https://www.cityofvancouver.us/business/permits-licenses-and-inspections/business-and-special-licenses/, or

https://dor.wa.gov/manage-business/city-license-endorsements/vancouver.

BUSINESS LICENSE REQUIREMENT

♦ In addition to any Washington State licensing requirements, each person or entity conducting business within Vancouver

city limits must hold a valid city business license. This includes companies with “remote employees” that work from a

location within the city. (See below for how to confirm if business or work location is within Vancouver city limits.)

♦ See below for instructions on how to apply for a city business license. Online application is preferred and fastest method.

NOTE: If business is sold, the city business license is not transferable to new owner.

VANCOUVER CITY LIMITS

♦ Below are 3 possible methods to confirm if your business location, project site, or

client is (or is not) in Vancouver city limits.

• Enter address at: https://www.cityofvancouver.us/about-vancouver/do-i-live-in-vancouver/

• Check “Jurisdiction” after entering address at Clark County Property Information Center website:

http://gis.clark.wa.gov/applications/gishome/property/index.cfm.

• Provide street address to city business licensing staff via email or phone (see above for contact information).

BUSINESS LICENSE APPLICATION PROCESS

♦ The city is partnered with the Washington State Department of Revenue (DOR), Business Licensing Service (BLS), for the

administration of its business licenses.

♦ Applications for city business licenses are processed via DOR’s business registration process. You can apply for a city

business license at the same time you first register your business with DOR, or can apply to add a city business license

under the account (UBI) of a business that is already registered with DOR. The city license will show as an “endorsement”

on the state business license.

♦ The state-issued Unified Business Identifier (UBI) is used to reference the city business license.

♦ Methods to apply for a Vancouver business license via DOR BLS:

Online (PREFERRED and FASTEST METHOD). Go to DOR website at:

https://secure.dor.wa.gov/home/.

Paper. Download Business License Application and City Addendum forms from DOR BLS’s Vancouver webpage:

https://dor.wa.gov/manage-business/city-license-endorsements/vancouver

, or request forms by contacting DOR BLS at

360-705-6741, or city business licensing staff, as noted above. Once completed, mail application, addendum, and check

or money order to DOR Business Licensing Service, PO BOX 9034, OLYMPIA WA 98507-9034. (Make check payable to

DEPARTMENT OF REVENUE.)

♦ QUESTIONS about application process or fees? Go to: https://dor.wa.gov/manage-business/city-license-

endorsements/vancouver, or contact DOR BLS at 360-705-6741, or city business licensing staff, as noted above.

CITY BUSINESS LICENSE INFORMATION, continued

Office: City Hall, 415 W 6th St, Vancouver WA 98660

Mail: PO Box 1995, Vancouver WA 98668-1995

Phone: 360-487-8410 option 3 Fax: 360-487-8483

Email: business.licenses@cityofvancouver.us

Website: https://www.cityofvancouver.us/businesslicense

City of Vancouver Business License Regulations, Mar 2024 Page 2 of 2

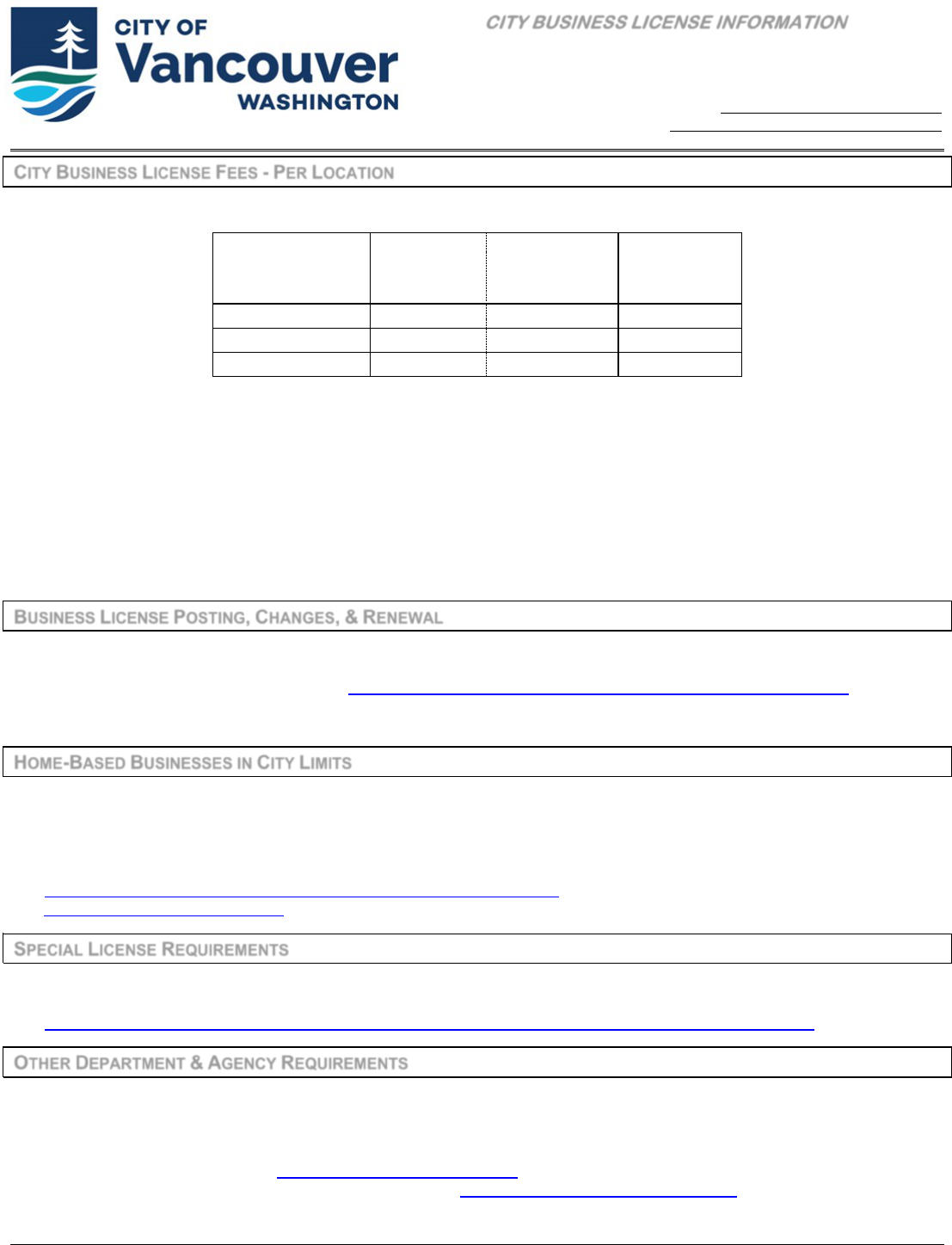

CITY BUSINESS LICENSE FEES - PER LOCATION

As of April 1, 2023, the following city fees are charged to apply for, or renew, a city business license.

Reported Gross

Annual Income

in City

License Fee

per License

Employee Fee

per Calculated

Employee

a

TOTAL

FEES

$0 - $2,000

$0.00

$0.00

$0.00

> $2,000 - $50,000

$50.00

$0.00

$50.00

> $50,000

$300.00

$105.00

$405.00

b

a

To calculate number of employees for a new business license, you will report on DOR application the estimated total employee

hours to be worked in city in coming 12 months; and for renewing license holders, report on annual renewal questionnaire the

total employee hours worked in city in previous 12 months or 4 quarters. (See definition of “employee” below.) DOR will then

divide total hours by 1,664 hours, and result will be rounded to nearest whole number before multiplying it by per employee fee.

Note: Resulting employee number may exceed business’s employee headcount. Minimum employee number is one.

b

This amount is minimum to be charged for an applicant, or renewing license holder, that reports a gross annual income of more

than $50,000, with 1 calculated employee.

“Employee” definition: Pay-rolled employees, self-employed persons, sole proprietors, owners, managers, and partners that

work in city limits.

BUSINESS LICENSE POSTING, CHANGES, & RENEWAL

♦ State/city license must be clearly posted at the physical address for which it was issued.

♦ To update business license account; see: https://dor.wa.gov/manage-business/update-my-business-information.

♦ Annually, DOR BLS will issue a renewal notice to the license holder in the month prior to the license expiration.

HOME-BASED BUSINESSES IN CITY LIMITS

♦ An individual may operate certain types of businesses from his/her residence, if operated in accordance with the

development

requirements set forth in VMC 20.860.020, and may need a Home Occupation Permit issued by the

Vancouver Community Development Department (CDD).

♦ To learn more about Home Occupation Permits and confirm if your business is required to obtain the permit, go to:

https://www.cityofvancouver.us/about-vancouver/do-i-live-in-vancouver/, or contact CDD at 360-487-7803 or

SPECIAL LICENSE REQUIREMENTS

♦ Certain businesses must obtain a city special license in addition to a city business license, e.g., mobile food vendors,

door

-to-door solicitors, pawnbrokers, etc. For a complete list of special licenses and related processes and fees, see:

https://www.cityofvancouver.us/business/permits-licenses-and-in

spections/business-and-special-licenses/ or contact city

business licensing staff, as noted above.

OTHER DEPARTMENT & AGENCY REQUIREMENTS

♦ In addition to complying with city business licensing regulations, you must comply with all other applicable city, county, state,

and federal regulations. Contact the applicable city departments or other agencies for those regulations.

♦ For city building, fire, and zoning code requirements, If applicable, contact the Vancouver Community Development

Department at 360-487-7803 or cddplanning@cityofvancouver.us

; and for city street use or right-of-way permits, contact the

Vancouver Public Works Department at 360-487-7729 or trafficengineering@cityofvancouver.us.