Section1ͲCRAPerformanceEvaluation

PUBLIC DISCLOSURE

July 10, 2023

COMMUNITY REINVESTMENT ACT

PERFORMANCE EVALUATION

The Shelby County State Bank

Certificate Number: 1553

508 Court St

Harlan, Iowa 51537

Federal Deposit Insurance Corporation

Division of Depositor and Consumer Protection

Kansas City Regional Office

1100 Walnut St, Suite 2100

Kansas City, Missouri 64106

This document is an evaluation of this institution’s record of meeting the credit needs of its entire

community, including low- and moderate-income neighborhoods, consistent with safe and sound

operation of the institution. This evaluation is not, nor should it be construed as, an assessment of the

financial condition of this institution. The rating assigned to this institution does not represent an

analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and

soundness of this financial institution.

TABLE OF CONTENTS

INSTITUTION RATING .......................................................................................................................... 1

DESCRIPTION OF INSTITUTION ......................................................................................................... 1

DESCRIPTION OF ASSESSMENT AREAS .......................................................................................... 2

SCOPE OF EVALUATION ...................................................................................................................... 3

CONCLUSIONS ON PERFORMANCE CRITERIA.............................................................................. 4

DISCRIMINATORY OR OTHER ILLEGAL CREDIT PRACTICES REVIEW .................................. 6

NORTHWEST IOWA ASSESSMENT AREA – Full-Scope Review ................................................ 6

OMAHA-COUNCIL BLUFFS, NE-IA METROPOLITAN STATISTICAL AREA ASSESSMENT

AREA – Full-Scope Review .............................................................................................................. 10

SIOUX CITY, IA-NE-SD MSA ASSESSMENT AREA – Full-Scope Review ................................... 14

APPENDICES ......................................................................................................................................... 18

SMALL BANK PERFORMANCE CRITERIA ............................................................................ 18

GLOSSARY ................................................................................................................................... 19

1

INSTITUTION RATING

INSTITUTION’S CRA RATING: This institution is rated Satisfactory.

An institution in this group has a satisfactory record of helping to meet the credit needs of its

assessment areas, including low- and moderate-income neighborhoods, in a manner consistent with

its resources and capabilities.

The Lending Test is rated Satisfactory.

• The loan-to-deposit ratio is reasonable given the bank’s size, financial condition, and

assessment areas’ credit needs.

• A majority of the small farm, small business, and home mortgage loans reviewed were

inside the assessment areas.

• The geographic distribution of loans was not performed as there are no low- or moderate-

income census tracts in the assessment areas.

• The distribution by borrowers reflects reasonable penetration among farms and businesses of

different sizes and individuals of different income levels.

• The bank did not receive any Community Reinvestment Act (CRA)-related complaints since

the previous evaluation; therefore, this criterion did not affect the Lending Test rating

DESCRIPTION OF INSTITUTION

The Shelby County State Bank (SCSB) is headquartered in Harlan, Iowa, a rural community located

in western Iowa. The bank is owned by Danes Holdings, Inc., a one-bank holding company located

in Omaha, Nebraska. The bank received a Satisfactory rating at its previous FDIC Performance

Evaluation, dated June 22, 2020, based on Interagency Small Institution Examination Procedures.

The bank operates 13 full-service branches throughout western and northwestern Iowa in the

following communities: Elk Horn, Harlan (2), Irwin, Panama, Portsmouth, and Shelby. The bank

also operates a limited-service branch at a retirement center in Harlan, Iowa. In addition, the bank

opened a new branch in Avoca, Iowa, on February 16, 2021. Avoca is located in Pottawattamie

County, Iowa, which is part of the Omaha-Council Bluffs, NE-IA Metropolitan Statistical Area.

Lastly, the bank merged with the former First State Bank, Ida Grove, Iowa, on February 1, 2022.

This resulted in the subject bank acquiring branches in Battle Creek, Danbury, Ida Grove,

Mapleton, and Odebolt, Iowa. Danbury is located in Woodbury County, Iowa, which is part of the

Sioux City, IA-NE-SD MSA. No other offices have been opened or closed since the previous

evaluation.

SCSB offers traditional loan products including agricultural, commercial, home mortgage,

and consumer loans. The bank’s primary business focus is agricultural lending. The bank provides

a variety of deposit services including checking, savings, money market deposit accounts, and

2

certificates of deposits. Alternative banking services include internet banking, mobile banking,

electronic bill pay, account-to-account transfers, and ATMs.

As of March 31, 2023, Consolidated Reports of Income and Condition (Call Report), the institution

reported total assets of $542.0 million, total loans of $337.3 million, and total deposits of $485.9

million. Agricultural loans, including loans secured by farmland, represent the largest loan

category, equaling 67.7 percent of total loans. Commercial loans, including commercial real estate

loans, rank second at 16.3 percent of total loans. Home loans comprises 11.6 percent of the

portfolio. The bank also originates and sells home mortgage loans to secondary market investors;

however, these loans are not reflected in the Call Report data listed below. Since the prior

evaluation, commercial and residential real estate loans have increased slightly while agricultural

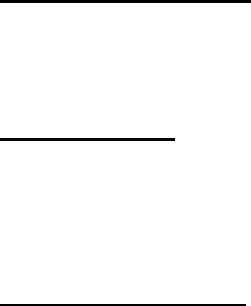

loans have decreased slightly by loan portfolio percentage. The following table details the loan

portfolio distribution.

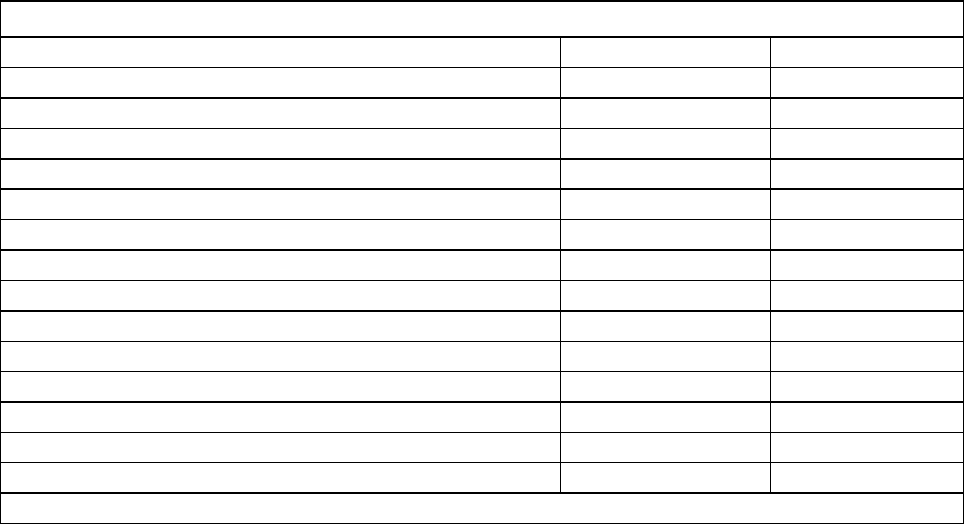

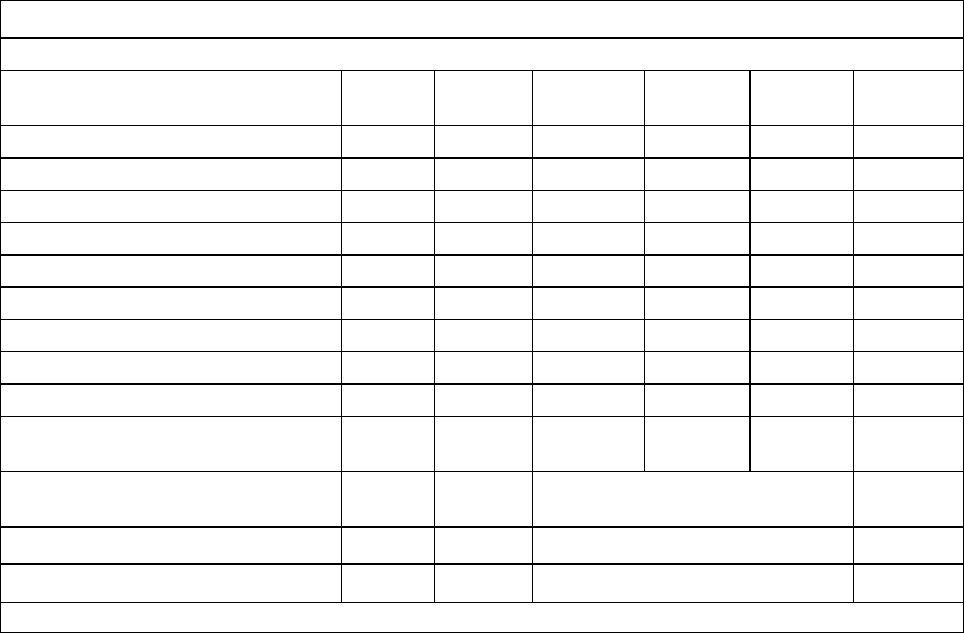

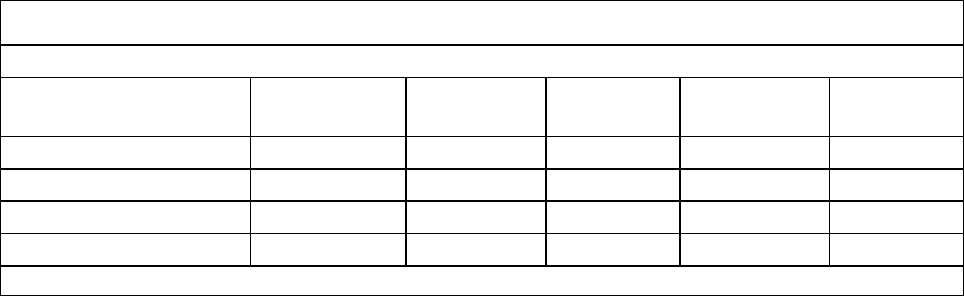

Loan Portfolio Distribution as of 3/31/2023

Loan Category

$(000s)

%

Construction, Land Development, and Other Land Loans

2,028

0.6

Secured by Farmland

92,801

27.5

Secured by 1-4 Family Residential Properties

39,027

11.6

Secured by Multifamily (5 or more) Residential Properties 116 <1.0

Secured by Nonfarm Nonresidential Properties

29,956

8.9

Total Real Estate Loans

163,928

48.6

Commercial and Industrial Loans

25,170

7.4

Agricultural Production and Other Loans to Farmers

135,522

40.2

Consumer Loans

11,139

3.3

Obligations of State and Political Subdivisions in the U.S.

0

0

Other Loans

1,516

0.5

Lease Financing Receivable (net of unearned income)

0

0

Less: Unearned Income

0

0

Total Loans 337,275 100.0

Source: Reports of Condition and Income

Examiners did not identify any financial, legal, or other impediments that affect the bank’s ability to

meet its assessment areas’ credit needs.

DESCRIPTION OF ASSESSMENT AREAS

The CRA requires each financial institution to define one or more assessment areas within which its

performance will be evaluated. The SCSB designated three separate assessment areas: 1)

Northwest Iowa Assessment Area, 2) Omaha-Council Bluffs, NE-IA MSA Assessment Area, and 3)

Sioux City, IA-NE-SD MSA Assessment area. A description of each assessment area is presented

in subsequent sections.

3

SCOPE OF EVALUATION

General Information

This evaluation covers the period from the prior evaluation dated June 22, 2020, to the current

evaluation dated July 10, 2023. Examiners used the Interagency Small Institution

Examination Procedures to conduct the evaluation.

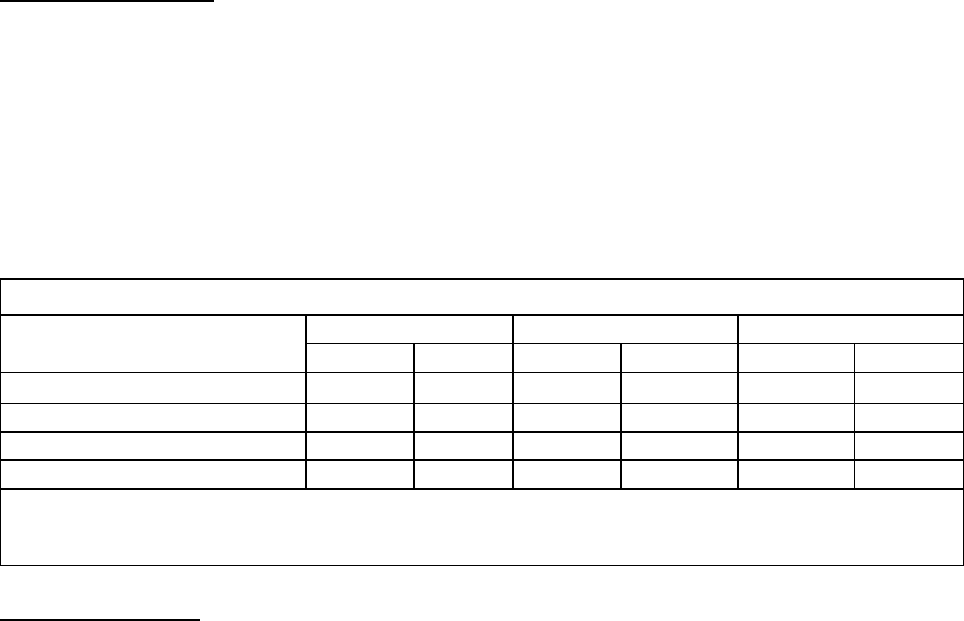

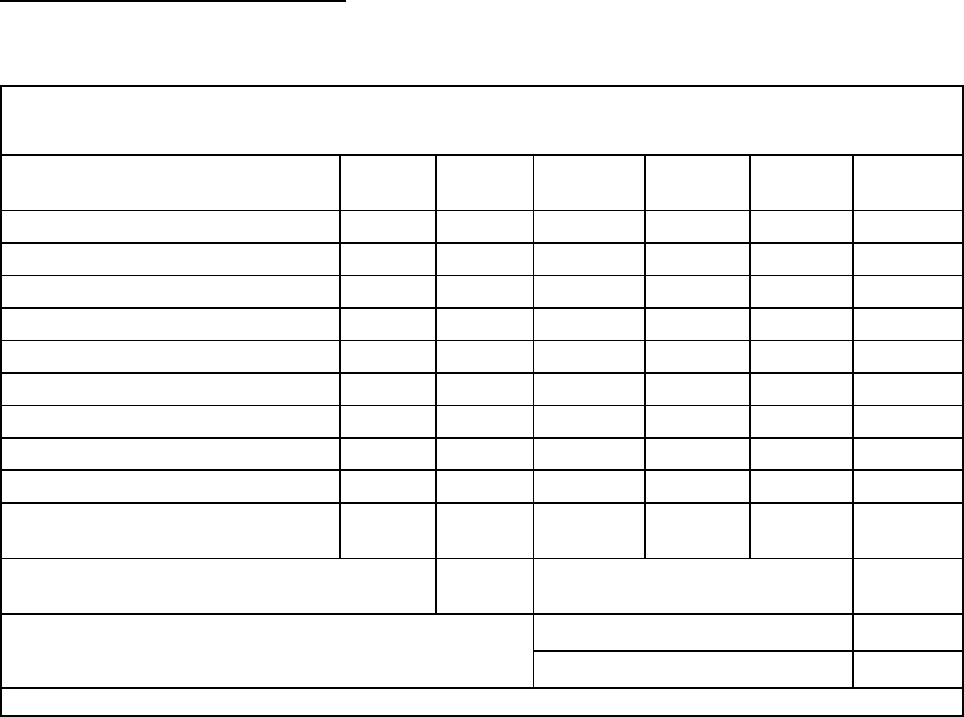

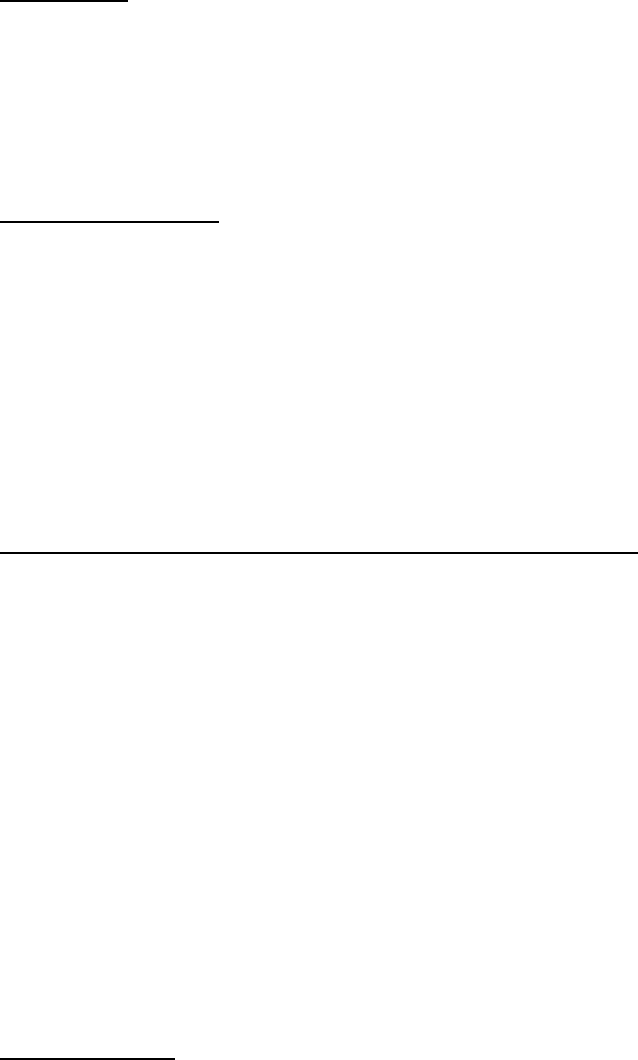

Examiners used full-scope examination procedures to assess the bank’s performance in each

assessment area. The Northwest Iowa Assessment Area received the most weight when evaluating

overall performance based on the breakdown of loans, deposits, and branches inside the respective

assessments areas as depicted in the following table. The table does not reflect loans originated

outside the respective assessment areas.

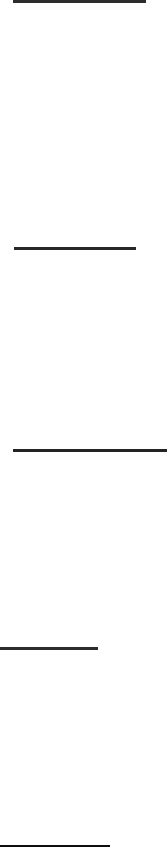

Breakdown of Loans, Deposits, and Branches

Assessment Area

Loans

Deposits***

Branches

$(000s)

%

$(000s)

%

#

%

Northwest Iowa

182,775*

80.8

470,570

95.3

11

84.6

Omaha-Council Bluffs MSA

36,513*

16.2

3,193

0.6

1

7.7

Sioux City MSA

6,808**

3.0

20,473

4.1

1

7.7

Total

226,096

100.0

494,236

100.0

13

100.0

Source: Bank Records.

*Based on original balances for loans originated between 06/01/2020 thru 05/02/2023.

**Based on original balances for loans originated between 02/01/2022 thru 01/27/2023.

***FDIC Summary of Deposits 06/30/2022.

Activities Reviewed

Examiners selected small farm, small business, and home mortgage loans to evaluate the

bank’s lending performance. Examiners selected these products based on the bank’s business

strategy and number and dollar volume of loans originated during the evaluation period. No

other loan types, such as consumer represent a major product line. As a result, examiners did

not review any other loan products, as they would provide no material support for conclusions

or the rating. The bank’s small farm lending performance received the most weight when

deriving overall conclusions. This is because agricultural loans represent the largest share of

loans by dollar volume.

Bank management indicated that small farm and small business lending in 2022 was generally

representative of the bank’s performance during the entire evaluation period. However, the

bank originated 311 Paycheck Protection Program (PPP) loans in 2020 totaling $10.5 million

and 495 PPP loans in 2021 totaling $9.6 million. Management indicated 2022 represented a

return to more normalized lending. The 2022 D&B data provided a standard of comparison for

the bank’s small farm and small business lending performance.

Examiners reviewed the entire universe of loans to evaluate the Assessment Area

Concentration. Geographic Distribution was not analyzed as none of the assessment areas

include any low- or moderate-income geographies. For the Borrower Profile criterion,

examiners reviewed the entire universe of small farm and small business loans originated in

the Sioux City, IA-NE-SD Assessment Area and the entire universe of the small business loans

originated in the Omaha-Council Bluffs, NE-IA Assessment Area due to limited volume. In

4

addition, examiners reviewed a sample of small farm, small business, and home mortgage

loans originated in the Northwest Iowa Assessment Area and a sample of small farm loans

originated in the Omaha-Council Bluffs, NE-IA Assessment Area. Home mortgage loans were

not reviewed in the Omaha-Council Bluffs, NE-IA or the Sioux City, IA-NE-SD Assessment

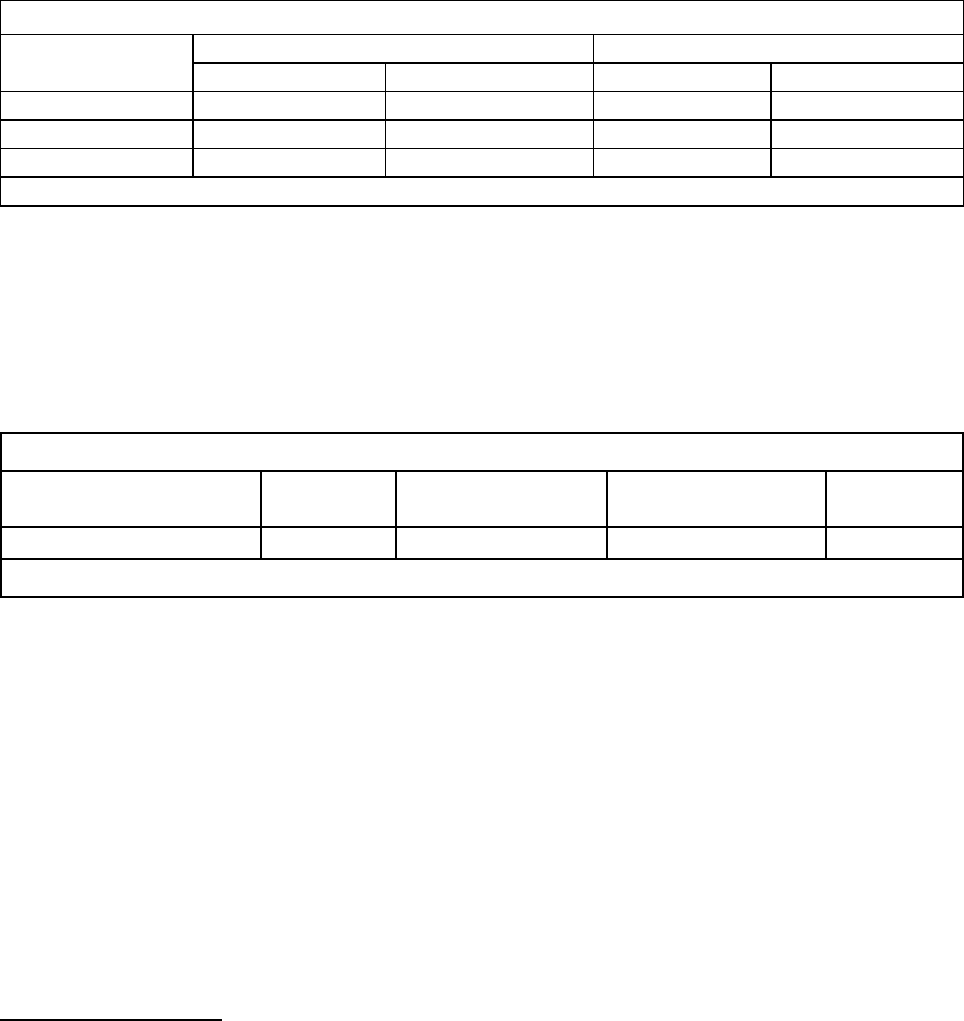

Areas as this loan type is not a primary product for these assessment areas. The table below

details the loans reviewed.

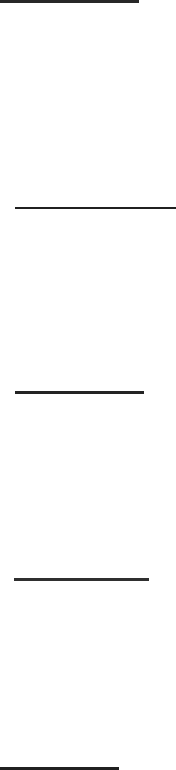

Loan Products Reviewed

Loan Category

Universe

Borrower Profile Review

#

$(000s)

#

$(000s)

Small Farm

407

44,839

127

13,238

Small Business

259

24,128

90

8,459

Home Mortgage

115

9,174

48

4,087

Source: Bank Data

The bank was not subject to the Home Mortgage Disclosure Act reporting requirements in 2022;

therefore, examiners used the bank data to identify home mortgage loans. Examiners used the

Federal Financial Institutions Examination Council’s (FFIEC’s) estimated 2022 median family

income figures for the Northwest Iowa Assessment Area to analyze home mortgage loans under the

Borrower Profile criterion. The following table details the income categories for each respective

year.

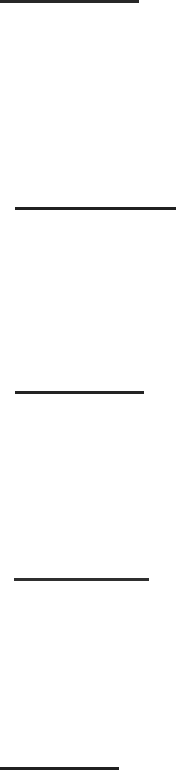

Median Family Income Ranges

Median Family Incomes

Low

<50%

Moderate

50% to <80%

Middle

80% to <120%

Upper

≥120%

2022 ($78,900)

<$39,450

$39,450 to <$63,120

$63,120 to <$94,680

≥$94,680

Source: FFIEC

While examiners reviewed both the number and dollar volume of loans and presented both figures

throughout the evaluation, examiners emphasized performance by number of loans when

conducting the Borrower Profile analyses. This is because the number of loans is a better indicator

of borrowers served.

CONCLUSIONS ON PERFORMANCE CRITERIA

LENDING TEST

SCSB demonstrated reasonable performance under the Lending Test. Reasonable performance

under the Loan-to-Deposit Ratio, Assessment Area Concentration, and Borrower Profile criteria

supports this conclusion.

Loan-to-Deposit Ratio

SCSB’s net loan-to-deposit ratio is reasonable given the institution’s size, financial condition,

and credit needs of the assessment areas. Examiners also considered the 248 secondary market

loans totaling nearly $38.9 million that are not reflected in the loan-to-deposit ratio. The

bank’s net loan-to-deposit ratio, calculated from Call Report data, averaged 70.1 percent over

5

the past 12 quarters from June 30, 2020, to March 31, 2023. The ratio ranged from a low of

62.8 percent on March 31, 2022, to a high of 77.2 percent on June 30, 2020. The bank’s net

loan-to-deposit ratio is on a slight downward trajectory since the prior evaluation.

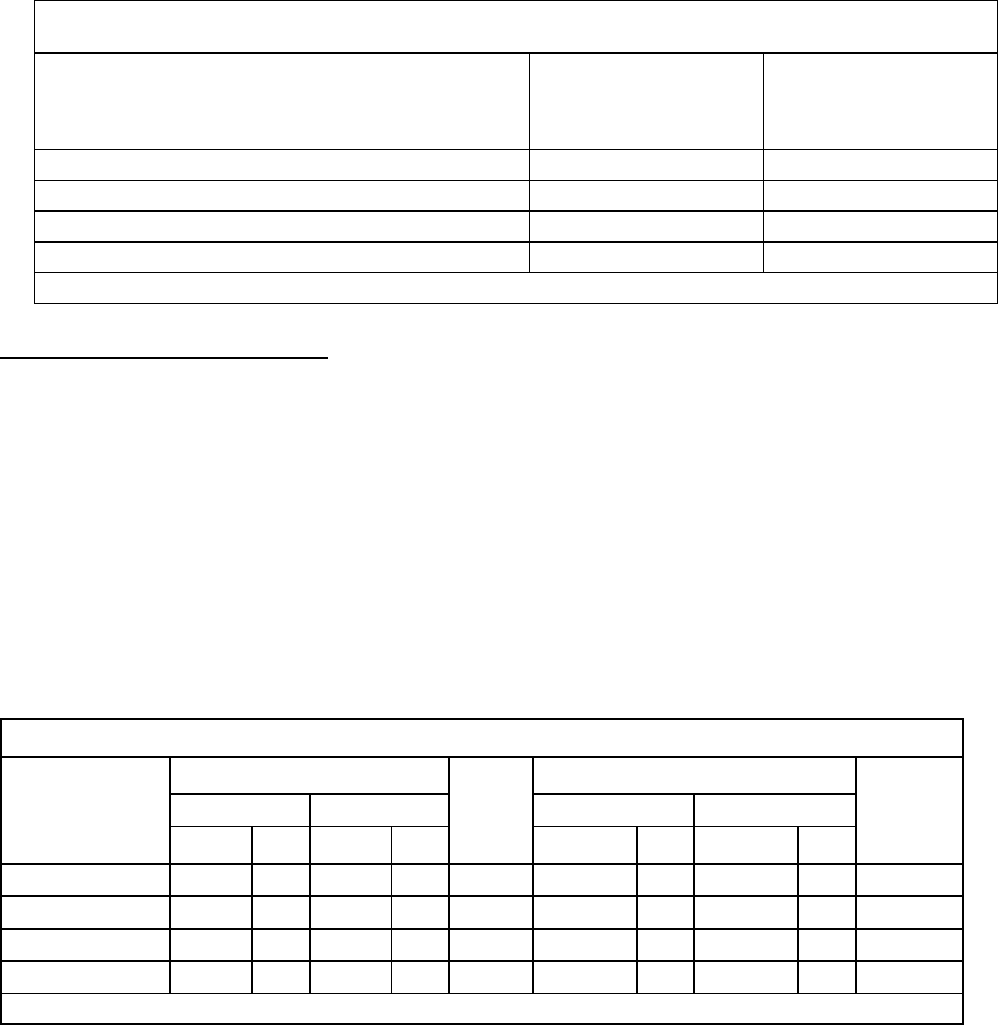

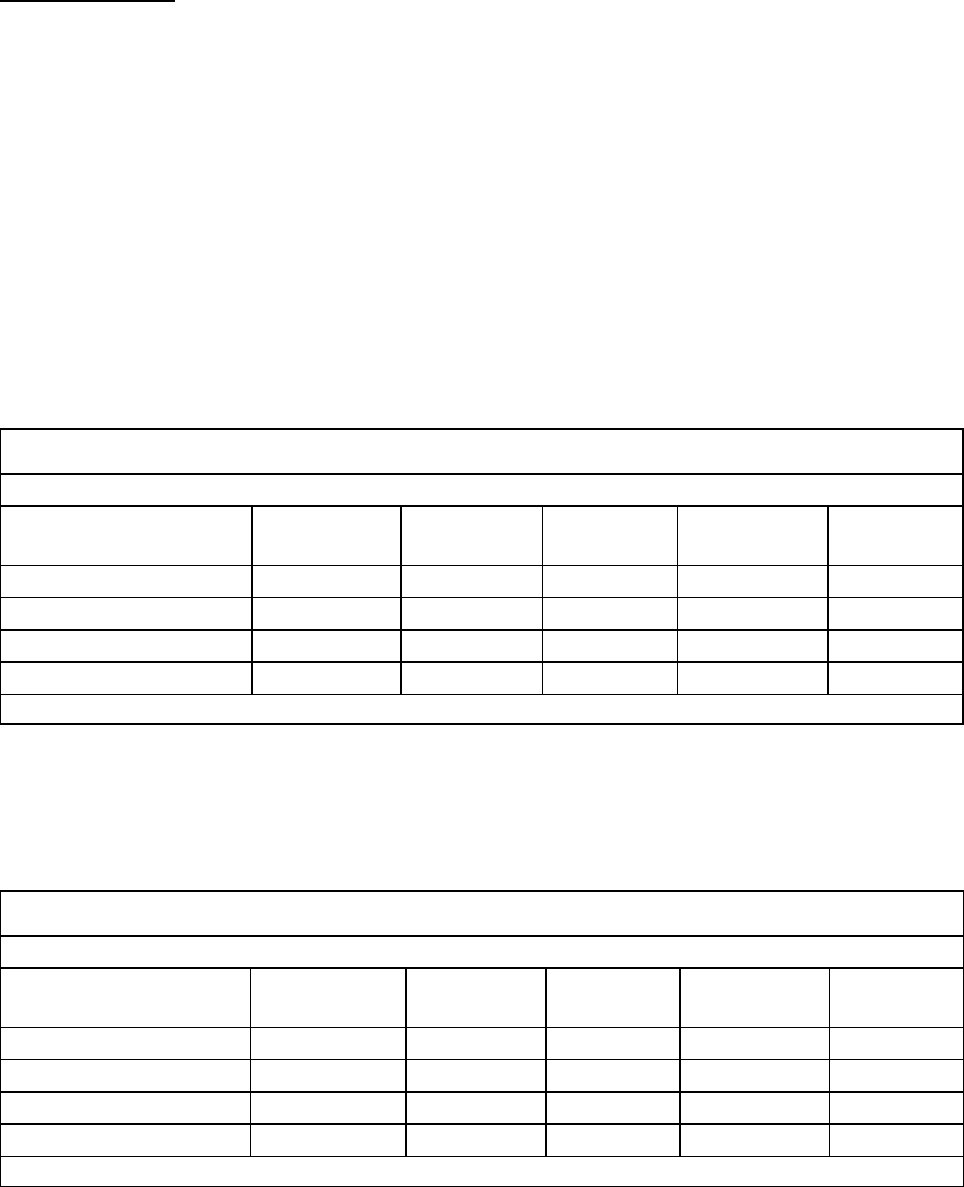

Examiners compared the bank’s average net loan-to-deposit ratio to three other financial

institutions. The comparable institutions were selected based on their asset size, geographic

location, and lending focus. Bank management also indicated the comparable banks listed

below are direct competitors. SCSB’s average net loan-to-deposit ratio is similar to the other

three comparable institutions. The following table provides details.

Loan-to-Deposit (LTD) Ratio

Comparison

Bank

Total Assets as

3/31/2023

$(000s)

Average Net LTD Ratio

(%)

The Shelby County State Bank, Harlan, IA

541,985

70.1

Midstates Bank, National, Council Bluffs, IA

654,586

64.5

Farmers Trust & Savings Bank, Earling, IA 141,624 62.1

United Bank of Iowa, Ida Grove, IA

2,316,503

80.2

Source: Reports of Condition and Income 6/30/2020 through 3/31/2023.

Assessment Area Concentration

Overall, a majority of the loans reviewed, by number and dollar volume, were located inside the

bank’s assessment areas. Although a majority of the small farm loans, by number and dollar

volume, were located outside the assessment areas, a majority of the small business and home

mortgage loans, by number and dollar volume, were located inside the assessment areas. The

majority of small farm loans located outside of the assessment areas were attributed to the bank

purchasing large numbers of participations from an affiliated financial institution. Bank

management indicated loan demand is lower in the area due to competitive forces such as Farm

Credit. As discussed later under the Northwest Iowa Assessment Area portion of this evaluation,

agricultural loan demand has declined due to many farmers having disposable income from recent

stimulus and relief efforts as well not needing credit because of high commodity prices.

Consequently, the bank has had to purchase participations from outside its area to supplement its

lending activity. The following table depicts the bank’s lending activity in its assessment areas.

Lending Inside and Outside of the Assessment Areas

Number of Loans

Dollar Amount of Loans $(000s)

Loan Category

Inside

Outside

Total

Inside

Outside

Total

#

%

#

%

#

$

%

$

%

$(000s)

Small Farm

407

41.1

583

58.9

990

44,839

44.9

55,099

55.1

99,938

Small Business

259

75.7

83

24.3

342

24,128

71.5

9,605

28.5

33,733

Home Mortgage

115

79.3

30

20.7

145

9,174

73.4

3,327

26.6

12,501

Total

781

52.9

696

47.1

1,477

78,141

53.5

68,031

46.5

146,172

Source: Bank Data. Due to rounding, totals may not equal 100.0%.

6

Geographic Distribution

The assessment areas do not contain any low- or moderate-income census tracts, and a review

would not result in meaningful conclusions. Therefore, examiners did not evaluate the geographic

distribution of loans.

Borrower Profile

The distribution of borrowers reflects reasonable penetration among farms and businesses of

different sizes and individuals of different incomes. Reasonable performance in all three

assessment areas supports this conclusion. Details are provided in the applicable assessment

area sections of this evaluation.

Response to Complaints

The bank did not receive any CRA-related complaints since the previous evaluation; therefore,

examiners did not evaluate the bank’s record of responding to CRA-related complaints.

DISCRIMINATORY OR OTHER ILLEGAL CREDIT PRACTICES REVIEW

Examiners did not identify any evidence of discriminatory or other illegal credit practices; therefore,

this consideration did not affect the institution’s overall CRA rating.

NORTHWEST IOWA ASSESSMENT AREA – Full-Scope Review

DESCRIPTION OF INSTITUTION’S OPERATIONS IN THE NORTHWEST

IOWA ASSESSMENT AREA

The Northwest Iowa Assessment Area is comprised of all of Shelby and Ida counties in Iowa,

census tract 0701.00 in Audubon County, census tracts 0701.00, 0702.00, and 0703.00 in Crawford

County, census tracts 9601.00 and 9604.00 in Monona County, and census tracts 0801.00 and

0802.00 in Sac County. The assessment area contains 14 middle-income and 1 upper-income

census tract. Census tracts 0701.00 in Audubon and 0801.00 and 0802.00 in Sac Counties were

classified as distressed and underserved middle-income census tracts from 2020 thru 2023. In

addition, census tracts 0701.00, 0702.00, 0703.00 in Crawford County and 0901.00, 0902.00, and

0903.00 in Ida County were classified as underserved middle-income census tracts from 2020 thru

2023.

The bank operates 11 full-service offices in Battle Creek, Elk Horn, Harlan (2), Ida Grove, Irwin,

Mapleton, Odebolt, Panama, Portsmouth, and Shelby, and one limited service office at the Elm

Crest Retirement Center in Harlan. The Odebolt branch is in a distressed and underserved middle-

income census tract, while the Battle Creek and Ida Grove branches are in distressed middle-

income census tracts. The bank also operates 11 ATMs in this assessment area, two of which are

located in distressed middle-income census tracts. As previously noted, the most amount of weight

was given to performance in this assessment area.

7

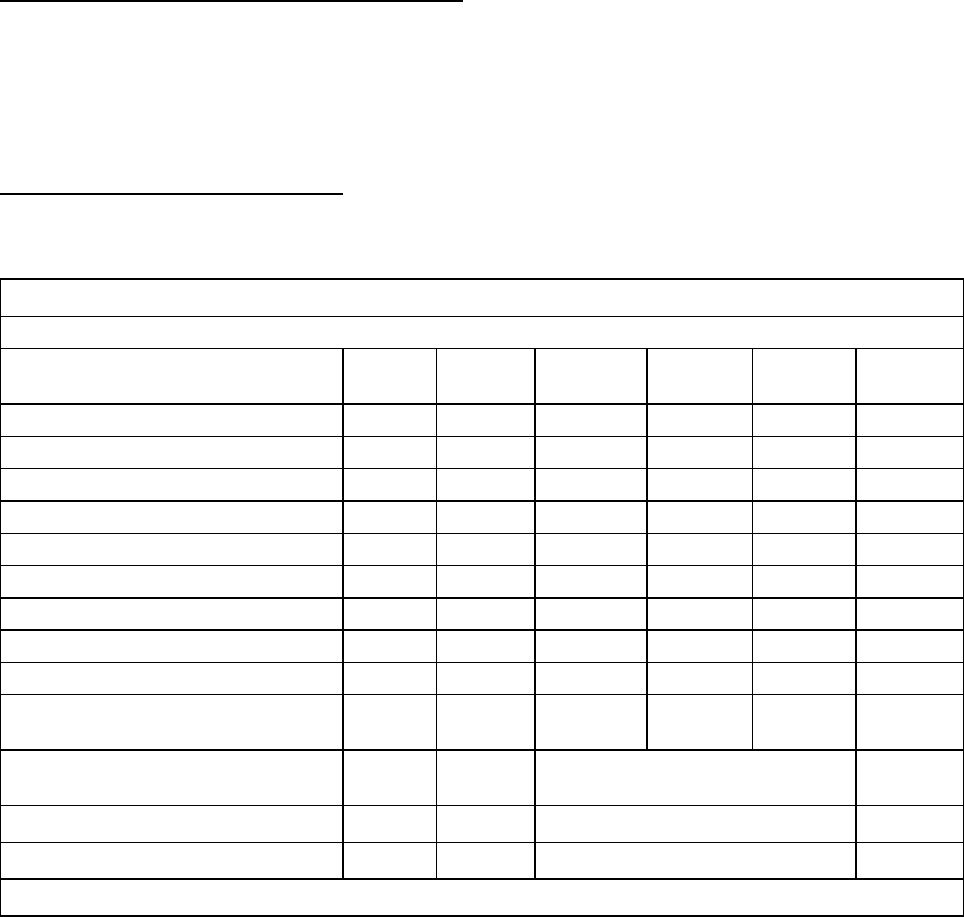

Economic and Demographic Data

The following table provides select demographic characteristics on the Northwest Iowa Assessment

Area.

Demographic Information of the Assessment Area

Assessment Area: Northwest Iowa

Demographic Characteristics #

Low

% of #

Moderate

% of #

Middle

% of #

Upper

% of #

NA*

% of #

Geographies (Census Tracts)

15

0.0

0.0

93.3

6.7

0.0

Population by Geography

35,256

0.0

0.0

90.6

9.4

0.0

Housing Units by Geography

17,802

0.0

0.0

90.7

9.3

0.0

Owner-Occupied Units by Geography

11,966

0.0

0.0

92.0

8.0

0.0

Occupied Rental Units by Geography

3,645

0.0

0.0

85.4

14.6

0.0

Vacant Units by Geography

2,191

0.0

0.0

92.9

7.1

0.0

Businesses by Geography

4,568

0.0

0.0

91.5

8.5

0.0

Farms by Geography

1,132

0.0

0.0

95.6

4.4

0.0

Family Distribution by Income Level

9,957

18.8

20.0

22.5

38.6

0.0

Household Distribution by Income

Level

15,611

21.9

16.6

19.6

42.0

0.0

Median Family Income Non-MSAs -

Iowa

$71,763

Median Housing Value

$105,357

Median Gross Rent

$631

Families Below Poverty Level

8.4%

Source: 2020 U.S. Census and 2022 D&B Data. Due to rounding, totals may not equal 100.0%.

The 2020 US Census data reveals that since the 2015 American Community Survey data,

population and housing has changed slightly. For instance, the population declined by 1,880

residents, or approximately 5.1 percent throughout this period. However, the total number of

housing units grew by 266 units, or approximately 1.5 percent. Of the 17,802 housing units in the

assessment area, 67.2 percent are owner-occupied, 20.5 percent are occupied rental units, and 12.3

percent are vacant.

Based on 2022 D&B data, the Northwest Iowa Assessment Area is dependent on agriculture with

19.9 percent of the assessment area businesses operating in agriculture. The number of farms in the

assessment area rose slightly based on 2017 Agricultural Census data. For instance, the number of

farms operating in counties included in the assessment area increased by 76, or 1.7 percent, between

the 2012 Agricultural Census and 2017 Agricultural Census. Further, 1,254 of the total 4,466

farming operations, or 28.1 percent, farm more than 500 acres each, confirming the presence of a

significant number of larger farming operations.

Employment opportunities remain prevalent within or near the assessment area, accounting for the

historically low unemployment levels during the vast majority of the evaluation period. The

unemployment rates for counties included in the assessment area ranged from 1.6 to 4.4 percent as

of May 2023, which is comparable to the State of Iowa’s unemployment rate of 2.6 percent as of the

same time. The unemployment rates were higher throughout part of the evaluation period due to the

8

COVID-19 pandemic, particularly during early 2020. However, labor statistic data confirms that

rates have generally trended downward since the end of the COVID-19 pandemic and remain low.

Competition

The Northwest Iowa Assessment Area is moderately competitive for financial services.

According to the FDIC Deposit Market Share data as of June 30, 2022, there were 25 financial

institutions operating 64 branches in the counties in the assessment area. Of these institutions,

SCSB ranked second with a 15.0 percent deposit market share. The bank competes with these

institutions, as well as credit unions and Farm Credit Services, for small farm and small

business loans.

Community Contact

As part of the evaluation process, examiners contact third parties active in the assessment area

to assist in identifying credit and community development needs. This information helps

determine whether local financial institutions are responsive to these needs. It also shows what

credit and community development opportunities are available.

Examiners reviewed a recent community contact conducted with a representative of a local

agricultural organization. The individual stated the area is dependent on agriculture and that the

farming community was really strong until inflation starting increasing. Many farmers still have a

lot of disposable income from stimulus and relief efforts. Land prices continue to escalate. Many

farmers have not needed credit because of high commodity prices. It is difficult for young farmers

to start out due to land, equipment, and input costs. USDA and Farm Service Agency offer

beginning farmer loans. There is strong competition among financial institutions and input dealers.

The contact said there are many hobby farms and that number will continue to rise. The contact

also indicated a significant need for affordable housing in the area.

Credit Needs

Based on information from the community contact, bank management, and demographic and

economic data, examiners concluded that small farm loans are the Northwest Iowa Assessment

Area’s primary credit need, followed by home mortgage loans and small business loans.

Furthermore, community development needs exist related to affordable housing, community

services for low- and moderate-income families, and economic development.

CONCLUSIONS ON PERFORMANCE CRITERIA IN NORTHWEST IOWA

ASSESSMENT AREA

LENDING TEST

SCSB demonstrated reasonable performance under the Lending Test in the Northwest Iowa

Assessment Area. Reasonable performance under the Borrower Profile criteria supports this

conclusion.

9

Borrower Profile

The distribution of borrowers reflects reasonable penetration among farms and businesses of

different sizes and individuals of different incomes. Reasonable small farm and small business

performance combined with excellent home mortgage lending performance supports this

conclusion.

Small Farm Loans

The distribution of borrowers reflects reasonable penetration among farms of different sizes. As

shown in the following table, the bank’s record of lending to farms with revenues of $1 million or

less slightly lagged 2022 D&B demographic data; however, several factors should be considered.

For example, 2017 Agricultural Census data confirms that there are 4,466 farming operations in the

counties included in this assessment area, with only 2,328, or 52.1 percent, reporting interest

expense. Moreover, 2017 Agricultural Census data reveals that 1,165 farms reported sales of less

than $2,500. This confirms that a large number of producers did not have any credit needs, which

are typically hobby farmers or smaller producers, which limits the bank’s opportunities to lend to

the smaller farms.

Distribution of Small Farm Loans by Gross Annual Revenue Category

Assessment Area: Northwest Iowa

Gross Revenue Level % of Farms # % $(000s) %

<=$1,000,000

99.0

52

88.1

3,661

67.7

>$1,000,000

0.5

7

11.9

2,147

32.3

Revenue Not Available

0.4

0

0.0

0

0.0

Total

100.0

59

100.0

5,808

100.0

Source: 2022 D&B Data, Bank Data. Due to rounding, totals may not equal 100.0%.

Small Business Loans

The distribution of borrowers reflects reasonable penetration among businesses of different sizes.

The bank’s lending activity, by number of loans, was generally in line with the percentage of

businesses with gross annual revenues of $1 million or less. The following table provides details.

Distribution of Small Business Loans by Gross Annual Revenue Category

Assessment Area: Northwest Iowa

Gross Revenue Level % of Businesses # % $(000s) %

<=$1,000,000

86.3

47

83.9

2,422

42.4

>$1,000,000

3.7

9

16.1

3,289

57.6

Revenue Not Available

10.0

0

0.0

0

0.0

Total

100.0

56

100.0

5,711

100.0

Source: 2022 D&B Data, Bank Data. Due to rounding, totals may not equal 100.0%.

10

Home Mortgage Loans

The distribution of borrowers reflects excellent penetration among individuals of different income

levels. As shown in the following table, the bank’s lending levels to low-income and moderate-

income borrowers is comparable to the percentage of low- and moderate-income families located in

the assessment area. However, the bank’s level of lending to low-income borrower is particularly

noteworthy given the 8.4 percent poverty rate and the significant need for affordable housing in the

assessment area. Both of these factors limits opportunities for low-income families to find and afford

a home.

Distribution of Home Mortgage Loans by Borrower Income Level

Assessment Area: Northwest Iowa

Borrower Income Level % of Families # % $(000s) %

Low

18.8

9

18.8

554

13.5

Moderate

20.0

11

22.9

428

10.5

Middle

22.5

7

14.6

602

14.7

Upper

38.6

19

39.6

2,438

59.7

Not Available

0.0

2

4.2

65

1.6

Total

100.0

48

100.0

4,087

100.0

Source: 2020 U.S. Census; Bank Data. Due to rounding, totals may not equal 100.0%.

OMAHA-COUNCIL BLUFFS, NE-IA METROPOLITAN STATISTICAL

AREA ASSESSMENT AREA – Full-Scope Review

DESCRIPTION OF INSTITUTION’S OPERATIONS IN OMAHA-COUNCIL

BLUFFS, NE-IA METROPOLITAN STATISTICAL AREA ASSESSMENT

AREA

The Omaha-Council Bluffs, NE-IA Metropolitan Statistical Area Assessment Area is comprised of

census tracts 2905.00 in Harrison County and 0215.02 in Pottawattamie County. Both census tracts

are classified as middle income. The bank operates one full-service office and one ATM in this

assessment area located in Avoca, Iowa. This branch was opened February 16, 2021. As

previously noted, 16.2 percent of total loans and only 0.6 percent of the bank’s total deposits are

from this assessment area.

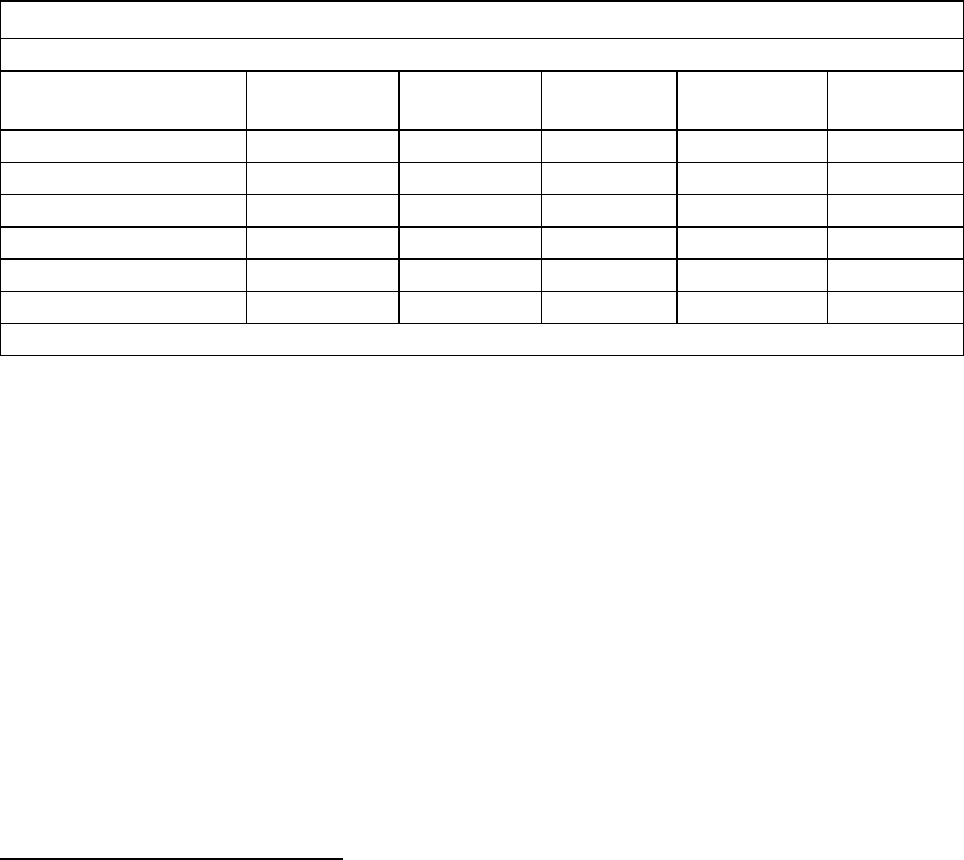

Economic and Demographic Data

The following table illustrates select demographic characteristics of the Omaha-Council Bluffs, NE-

IA MSA Assessment Area.

11

Demographic Information of the Assessment Area

Assessment Area: Omaha-Council Bluffs, NE-IA MSA

Demographic Characteristics #

Low

% of #

Moderate

% of #

Middle

% of #

Upper

% of #

NA*

% of #

Geographies (Census Tracts)

2

0.0

0.0

100.0

0.0

0.0

Population by Geography

5,502

0.0

0.0

100.0

0.0

0.0

Housing Units by Geography

2,423

0.0

0.0

100.0

0.0

0.0

Owner-Occupied Units by Geography

1,689

0.0

0.0

100.0

0.0

0.0

Occupied Rental Units by Geography

491

0.0

0.0

100.0

0.0

0.0

Vacant Units by Geography

243

0.0

0.0

100.0

0.0

0.0

Businesses by Geography

647

0.0

0.0

100.0

0.0

0.0

Farms by Geography

145

0.0

0.0

100.0

0.0

0.0

Family Distribution by Income Level

1,473

20.6

21.0

23.5

34.9

0.0

Household Distribution by Income

Level

2,180

25.9

18.1

18.6

37.5

0.0

Median Family Income MSA - 36540

Omaha-Council Bluffs, NE-IA MSA

$87,733

Median Housing Value

$153,715

Median Gross Rent

$728

Families Below Poverty Level

5.4%

Source: 2020 U.S. Census and 2022 D&B Data. Due to rounding, totals may not equal 100.0%.

The 2020 US Census data reveals since the 2015 American Community Survey data, population and

housing has increased. The population increased by 140 residents, or approximately 2.6 percent

throughout this period. In addition, the total number of housing units grew by 52 units, or

approximately 2.2 percent. Of the 2,423 housing units in the assessment area, 69.7 percent are

owner-occupied, 20.3 percent are occupied rental units, and 10.0 percent are vacant.

Based on 2022 D&B data, the Omaha-Council Bluffs, NE-IA Assessment Area is dependent on

agriculture with 18.3 percent of the assessment area businesses operating in agriculture. The

number of farms in the assessment area declined slightly based on 2017 Agricultural Census data.

For instance, the number of farms operating in counties included in the assessment area decreased

by 99, or 4.9 percent, between the 2012 Agricultural Census and 2017 Agricultural Census.

Further, 533 of the total 1,908 farming operations, or 27.9 percent, farm more than 500 acres each,

confirming the presence of a significant number of larger farming operations.

Employment opportunities remain prevalent within or near the assessment area, accounting for the

historically low unemployment levels during the vast majority of the evaluation period. The

unemployment rates for counties included in the assessment area ranged from 2.3 to 2.5 percent as

of May 2023, which is comparable to the State of Iowa’s unemployment rate of 2.6 percent as of the

same time. The unemployment rates were higher throughout part of the evaluation period due to the

COVID-19 pandemic, particularly during early 2020. However, labor statistic data confirms that

rates have generally trended downward since the end of the COVID-19 pandemic and remain low.

12

Competition

The Omaha-Council Bluffs, NE-IA MSA Assessment Area is moderately competitive for financial

services. According to the FDIC Deposit Market Share data as of June 30, 2022, there were 12

financial institutions operating 32 branches in the counties within the assessment area. Of these

institutions, SCSB ranked last with a 0.1 percent deposit market share. The bank competes with

these institutions, as well as credit unions and Farm Credit Services, for small farm and small

business loans.

Community Contacts

Examiners reviewed a community contact conducted with a representative from an organization that

connects Iowans with resources within the state. The contact stated the demographics of the area

are mixed between the Council Bluffs area and the rest of the county, which is more rural. In the

more rural areas, jobs are more related to agricultural and smaller “mom and pop” businesses. The

commercial sector continues to rebound from the pandemic with the biggest challenge being a

shortage of qualified workers. There is a high demand for labor and a limited number of available

employees. As a result, many businesses have been offering hiring incentives and flexible

scheduling to attract new workers. With regard to the farming economy, higher commodity prices

have helped offset higher input costs. There is a lack of affordable housing in the area and rising

interest rates have made it difficult to purchase a home.

Credit and Community Development Needs and Opportunities

Based on information from the community contact, bank management, and demographic and

economic data, examiners concluded that small farm loans are the Omaha-Council Bluffs, NE-

IA MSA Assessment Area’s primary credit need followed by small business and home

mortgage loans. Furthermore, community development needs exist related to affordable

housing, community services for low- and moderate-income families, and economic

development.

CONCLUSIONS ON PERFORMANCE CRITERIA IN THE OMAHA-

COUNCIL BLUFFS, NE-IA MSA AA

LENDING TEST

SCSB demonstrated reasonable performance under the Lending Test in the Omaha-Council Bluffs,

NE-IA MSA Assessment Area. Reasonable performance under the Borrower Profile criteria supports

this conclusion.

Borrower Profile

The distribution of borrowers reflects reasonable penetration among farms and businesses of

different sizes. Reasonable small farm and small business lending performance supports this

conclusion. Home mortgage loans are not a primary product in this assessment area and were not

reviewed.

13

Small Farm Loans

The distribution of borrowers reflects reasonable penetration among farms of different sizes. As

shown in the following table, the bank’s record of lending to farms with revenues of $1 million or

less slightly lags 2022 D&B demographic data; however, several factors should be considered. For

example, 2017 Agricultural Census data confirms that there are 1,908 farming operations in

counties included in this assessment area, with only 910, or 47.7 percent, reporting interest expense.

Moreover, 2017 Agricultural Census data reveals that 502 farms reported sales of less than $2,500.

This confirms that a large number of producers did not have any credit needs, which are typically

hobby farmers or smaller producers, which limits the bank’s opportunities to lend to the smaller

farms.

Distribution of Small Farm Loans by Gross Annual Revenue Category

Assessment Area: Omaha-Council Bluffs, NE-IA MSA

Gross Revenue Level % of Farms # % $(000s) %

<=$1,000,000

100.0

29

93.5

4,068

83.6

>$1,000,000

0.0

2

6.5

800

16.4

Revenue Not Available

0.0

0

0.0

0

0.0

Total

100.0

31

100.0

4,868

100.0

Source: 2022 D&B Data, Bank Data. Due to rounding, totals may not equal 100.0%.

Small Business Loans

The distribution of borrowers reflects reasonable penetration among businesses of different sizes.

The bank’s lending activity, by number of loans, was slightly above the percentage of businesses

with gross annual revenues of $1 million or less. The following table provides details.

Distribution of Small Business Loans by Gross Annual Revenue Category

Assessment Area: Omaha-Council Bluffs, NE-IA MSA

Gross Revenue Level % of Businesses # % $(000s) %

<=$1,000,000

86.6

17

89.5

929

41.7

>$1,000,000

2.3

2

10.5

1,300

58.3

Revenue Not Available

11.1

0

0.0

0

0.0

Total

100.0

19

100.0

2,229

100.0

Source: 2022 D&B Data, Bank Data. Due to rounding, totals may not equal 100.0%.

14

SIOUX CITY, IA-NE-SD MSA ASSESSMENT AREA – Full-Scope Review

DESCRIPTION OF INSTITUTION’S OPERATIONS IN THE SIOUX CITY,

IA-NE-SD MSA ASSESSMENT AREA

Sioux City, IA-NE-SD MSA Assessment Area

The Sioux City, IA-NE-SD MSA Assessment Area is comprised of census tract 0031.00 in

Woodbury County, Iowa. This census tract is classified as middle income. The bank operates one

full-service office and one ATM in this assessment area located in Danbury, Iowa. This branch was

acquired by the subject bank as of February 1, 2022. As previously noted, only 3.0 percent of the

bank’s total loans and 4.1 percent of total deposits are from this assessment area.

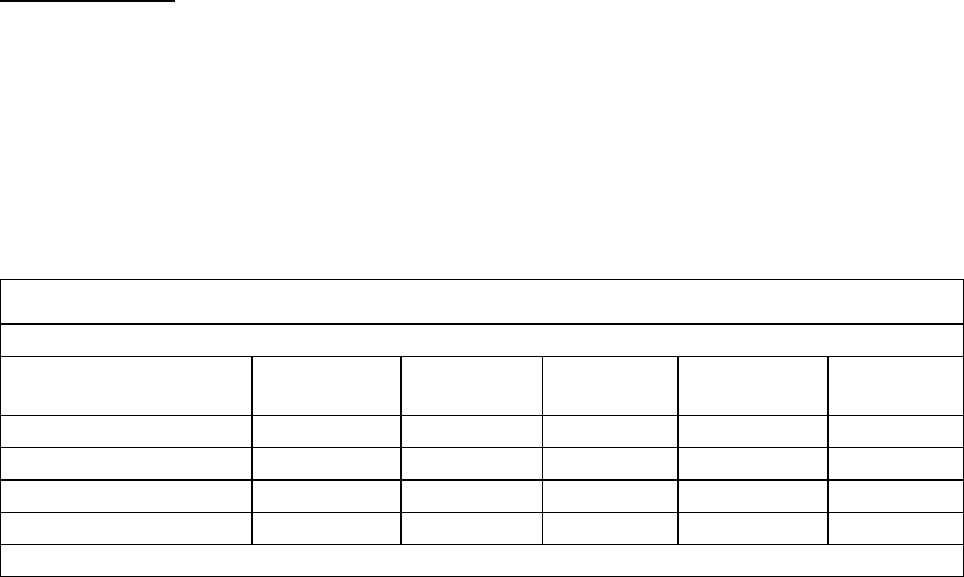

Economic and Demographic Data

The following table provides select demographic characteristics on the Sioux City, IA-NE-SD MSA

Assessment Area.

Demographic Information of the Assessment Area

Assessment Area: Sioux City, IA-NE-SD MSA

Demographic Characteristics #

Low

% of #

Moderate

% of #

Middle

% of #

Upper

% of #

NA*

% of #

Geographies (Census Tracts)

1

0.0

0.0

100.0

0.0

0.0

Population by Geography

3,660

0.0

0.0

100.0

0.0

0.0

Housing Units by Geography

1,870

0.0

0.0

100.0

0.0

0.0

Owner-Occupied Units by Geography

1,322

0.0

0.0

100.0

0.0

0.0

Occupied Rental Units by Geography

301

0.0

0.0

100.0

0.0

0.0

Vacant Units by Geography

247

0.0

0.0

100.0

0.0

0.0

Businesses by Geography

432

0.0

0.0

100.0

0.0

0.0

Farms by Geography

104

0.0

0.0

100.0

0.0

0.0

Family Distribution by Income Level

1,120

16.0

18.2

29.0

36.8

0.0

Household Distribution by Income

Level

1,623

21.5

17.7

22.4

38.4

0.0

Median Family Income MSA - 43580

Sioux City, IA-NE-SD MSA

$74,387

Median Housing Value

$89,700

Median Gross Rent

$672

Families Below Poverty Level

4.6%

Source: 2020 U.S. Census and 2022 D&B Data. Due to rounding, totals may not equal 100.0%.

The 2020 US Census data reveals since the 2015 American Community Survey data, the population

declined by 251 residents, or approximately 6.4 percent throughout this period. In addition, the

total number of housing units declined by 34 units, or approximately 1.8 percent. Of the 1,870

housing units in the assessment area, 70.7 percent are owner-occupied, 16.1 percent are occupied

rental units, and 13.2 percent are vacant.

15

Based on 2022 D&B data, the Sioux City, IA-NE-SD Assessment Area is dependent on agriculture

with 19.4 percent of the assessment area businesses operating in agriculture. The number of farms

in the assessment area rose slightly based on 2017 Agricultural Census data. For instance, the

number of farms operating in Woodbury Count increased by 64, or 6.6 percent, between the 2012

Agricultural Census and 2017 Agricultural Census. Further, 262 of the total 1,037 farming

operations, or 25.3 percent, farm more than 500 acres each, confirming the presence of a significant

number of larger farming operations.

Employment opportunities remain prevalent within or near the assessment area, accounting for the

historically low unemployment levels during the vast majority of the evaluation period. The

unemployment rates for Woodbury County was 2.5 percent as of May 2023, which is comparable to

the State of Iowa unemployment rate of 2.6 percent as of the same time. The unemployment rates

were higher throughout part of the evaluation period due to the COVID-19 pandemic, particularly

during early 2020. However, labor statistic data confirms that rates have generally trended

downward since the end of the COVID-19 pandemic and remain low.

Competition

The Sioux City, IA-NE-SD MSA Assessment Area is moderately competitive for financial services.

According to the FDIC Deposit Market Share data as of June 30, 2022, there were 21 financial

institutions operating 47 branches in counties within the assessment area. Of these institutions,

SCSB ranked 19

th

with a 0.6 percent deposit market share. The bank competes with these

institutions, as well as credit unions and Farm Credit Services, for small farm and small business

loans.

Community Contact

Examiners reviewed a recent community contact conducted with a representative of a local

economic development group that focuses on increasing and enhancing employment opportunities.

The individual stated the economy is heavily based on food processing plants and manufacturing.

There is a shortage of qualified workers. Wages have increased in the last few years with many

employers offering incentives to potential employees. There is not enough housing stock.

Reportedly, there are some housing projects underway but they are out of the reach of low- and

moderate-income individuals; however, it does open up some mid-level housing as middle-income

individuals ‘buy up’. The value of farm land has risen dramatically and is out of reach for

beginning farmers. The larger farm operations generally have more and larger credit needs while

smaller farms have less credit needs. Farmers seek credit from banks and input dealers.

Credit Needs

Based on information from the community contact, bank management, and demographic and

economic data, examiners concluded that small farm loans are the Sioux City, IA-NE-SD

Assessment Area’s primary credit need, followed by home mortgage loans and small business

loans. Furthermore, community development needs exist related to affordable housing, community

services for low- and moderate-income families, and economic development.

16

CONCLUSIONS ON PERFORMANCE CRITERIA IN THE SIOUX CITY, IA-

NE-SD MSA ASSESSMENT AREA

LENDING TEST

SCSB demonstrated reasonable performance under the Lending Test in the Sioux City, IA-NE-SD

MSA Assessment Area. Reasonable performance under the Borrower Profile criteria supports this

conclusion. This assessment area received the least amount of weight due to the limited deposit and

lending activity occurring in this area.

Borrower Profile

The distribution of borrowers reflects reasonable penetration among farms and businesses of

different sizes. The bank’s reasonable small farm and small business lending performance supports

this conclusion. Home mortgage loans are not a primary product in this assessment area and were

not reviewed.

Small Farm Loans

The distribution of borrowers reflects reasonable penetration among farms of different sizes. As

shown in the following table, the bank’s record of lending to farms with revenues of $1 million or

less slightly lags 2022 D&B demographic data; however, the performance is still reasonable.

Distribution of Small Farm Loans by Gross Annual Revenue Category

Assessment Area: Sioux City, IA-NE-SD MSA

Gross Revenue Level % of Farms # % $(000s) %

<=$1,000,000

99.0

34

91.9

2,142

83.6

>$1,000,000

1.0

3

8.1

420

16.4

Revenue Not Available

0.0

0

0.0

0

0.0

Total

100.0

37

100.0

2,562

100.0

Source: 2022 D&B Data, Bank Data. Due to rounding, totals may not equal 100.0%.

Small Business Loans

The distribution of borrowers reflects reasonable penetration among businesses of different sizes.

The bank’s lending activity, by number of loans, was slightly below the percentage of businesses

with gross annual revenues of $1 million or less. The following table provides details.

17

Distribution of Small Business Loans by Gross Annual Revenue Category

Assessment Area: Sioux City, IA-NE-SD MSA

Gross Revenue Level % of Businesses # % $(000s) %

<=$1,000,000

85.6

12

80.0

371

71.5

>$1,000,000

1.9

3

20.0

148

28.5

Revenue Not Available

12.5

0

0.0

0

0.0

Total

100.0

15

100.0

519

100.0

Source: 2022 D&B Data, Bank Data. Due to rounding, totals may not equal 100.0%.

18

APPENDICES

SMALL BANK PERFORMANCE CRITERIA

Lending Test

The Lending Test evaluates the bank’s record of helping to meet the credit needs of its assessment

area(s) by considering the following criteria:

1) The bank’s loan-to-deposit ratio, adjusted for seasonal variation, and, as appropriate, other

lending-related activities, such as loan originations for sale to the secondary markets,

community development loans, or qualified investments;

2) The percentage of loans, and as appropriate, other lending-related activities located in the

bank’s assessment area(s);

3) The geographic distribution of the bank’s loans;

4) The institution’s record of lending to and, as appropriate, engaging in other lending-related

activities for borrowers of different income levels and businesses and farms of different

sizes; and

5) The bank’s record of taking action, if warranted, in response to written complaints about its

performance in helping to meet credit needs in its assessment area(s).

19

GLOSSARY

Aggregate Lending: The number of loans originated and purchased by all reporting lenders in

specified income categories as a percentage of the aggregate number of loans originated and

purchased by all reporting lenders in the metropolitan area/assessment area.

American Community Survey (ACS): A nationwide United States Census survey that produces

demographic, social, housing, and economic estimates in the form of five year estimates based on

population thresholds.

Area Median Income: The median family income for the MSA, if a person or geography is

located in an MSA; or the statewide nonmetropolitan median family income, if a person or

geography is located outside an MSA.

Assessment Area: A geographic area delineated by the institution under the requirements of the

Community Reinvestment Act.

Census Tract: A small, relatively permanent statistical subdivision of a county or equivalent

entity. The primary purpose of census tracts is to provide a stable set of geographic units for the

presentation of statistical data. Census tracts generally have a population size between 1,200 and

8,000 people, with an optimum size of 4,000 people. Census tract boundaries generally follow

visible and identifiable features, but they may follow nonvisible legal boundaries in some

instances. State and county boundaries always are census tract boundaries.

Combined Statistical Area (CSA): A combination of several adjacent metropolitan statistical

areas or micropolitan statistical areas or a mix of the two, which are linked by economic ties.

Consumer Loan(s): A loan(s) to one or more individuals for household, family, or other personal

expenditures. A consumer loan does not include a home mortgage, small business, or small farm

loan. This definition includes the following categories: motor vehicle loans, credit card loans, home

equity loans, other secured consumer loans, and other unsecured consumer loans.

Core Based Statistical Area (CBSA): The county or counties or equivalent entities associated

with at least one core (urbanized area or urban cluster) of at least 10,000 population, plus adjacent

counties having a high degree of social and economic integration with the core as measured through

commuting ties with the counties associated with the core. Metropolitan and Micropolitan

Statistical Areas are the two categories of CBSAs.

Family: Includes a householder and one or more other persons living in the same household who

are related to the householder by birth, marriage, or adoption. The number of family households

always equals the number of families; however, a family household may also include non-relatives

living with the family. Families are classified by type as either a married-couple family or other

family. Other family is further classified into “male householder” (a family with a male

householder and no wife present) or “female householder” (a family with a female householder and

no husband present).

20

FFIEC-Estimated Income Data: The Federal Financial Institutions Examination Council (FFIEC)

issues annual estimates which update median family income from the metropolitan and

nonmetropolitan areas. The FFIEC uses American Community Survey data and factors in

information from other sources to arrive at an annual estimate that more closely reflects current

economic conditions.

Full-Scope Review: A full-scope review is accomplished when examiners complete all applicable

interagency examination procedures for an assessment area. Performance under applicable tests is

analyzed considering performance context, quantitative factors (e.g, geographic distribution,

borrower profile, and total number and dollar amount of investments), and qualitative factors (e.g,

innovativeness, complexity, and responsiveness).

Geography: A census tract delineated by the United States Bureau of the Census in the most recent

decennial census.

Home Mortgage Disclosure Act (HMDA): The statute that requires certain mortgage lenders that

do business or have banking offices in a metropolitan statistical area to file annual summary reports

of their mortgage lending activity. The reports include such data as the race, gender, and the

income of applicants; the amount of loan requested; and the disposition of the application

(approved, denied, and withdrawn).

Home Mortgage Loans: Includes closed-end mortgage loans or open-end line of credits as defined

in the HMDA regulation that are not an excluded transaction per the HMDA regulation.

Housing Unit: Includes a house, an apartment, a mobile home, a group of rooms, or a single room

that is occupied as separate living quarters.

Limited-Scope Review: A limited-scope review is accomplished when examiners do not complete

all applicable interagency examination procedures for an assessment area.

Performance under applicable tests is often analyzed using only quantitative factors (e.g, geographic

distribution, borrower profile, total number and dollar amount of investments, and branch

distribution).

Low-Income: Individual income that is less than 50 percent of the area median income, or a

median family income that is less than 50 percent in the case of a geography.

Market Share: The number of loans originated and purchased by the institution as a percentage of

the aggregate number of loans originated and purchased by all reporting lenders in the metropolitan

area/assessment area.

Median Income: The median income divides the income distribution into two equal parts, one

having incomes above the median and other having incomes below the median.

Metropolitan Division (MD): A county or group of counties within a CBSA that contain(s) an

urbanized area with a population of at least 2.5 million. A MD is one or more main/secondary

counties representing an employment center or centers, plus adjacent counties associated with the

main/secondary county or counties through commuting ties.

21

Metropolitan Statistical Area (MSA): CBSA associated with at least one urbanized area having a

population of at least 50,000. The MSA comprises the central county or counties or equivalent

entities containing the core, plus adjacent outlying counties having a high degree of social and

economic integration with the central county or counties as measured through commuting.

Middle-Income: Individual income that is at least 80 percent and less than 120 percent of the area

median income, or a median family income that is at least 80 and less than 120 percent in the case

of a geography.

Moderate-Income: Individual income that is at least 50 percent and less than 80 percent of the

area median income, or a median family income that is at least 50 and less than 80 percent in the

case of a geography.

Multi-family: Refers to a residential structure that contains five or more units.

Nonmetropolitan Area (also known as non-MSA): All areas outside of metropolitan areas. The

definition of nonmetropolitan area is not consistent with the definition of rural areas. Urban and

rural classifications cut across the other hierarchies. For example, there is generally urban and rural

territory within metropolitan and nonmetropolitan areas.

Owner-Occupied Units: Includes units occupied by the owner or co-owner, even if the unit has

not been fully paid for or is mortgaged.

Rated Area: A rated area is a state or multistate metropolitan area. For an institution with

domestic branches in only one state, the institution’s CRA rating would be the state rating. If an

institution maintains domestic branches in more than one state, the institution will receive a rating

for each state in which those branches are located. If an institution maintains domestic branches in

two or more states within a multistate metropolitan area, the institution will receive a rating for the

multistate metropolitan area.

Rural Area: Territories, populations, and housing units that are not classified as urban.

Small Business Loan: A loan included in “loans to small businesses” as defined in the

Consolidated Report of Condition and Income (Call Report). These loans have original amounts of

$1 million or less and are either secured by nonfarm nonresidential properties or are classified as

commercial and industrial loans.

Small Farm Loan: A loan included in “loans to small farms” as defined in the instructions for

preparation of the Consolidated Report of Condition and Income (Call Report). These loans have

original amounts of $500,000 or less and are either secured by farmland, including farm residential

and other improvements, or are classified as loans to finance agricultural production and other loans

to farmers.

Upper-Income: Individual income that is 120 percent or more of the area median income, or a

median family income that is 120 percent or more in the case of a geography.

Urban Area: All territories, populations, and housing units in urbanized areas and in places of

2,500 or more persons outside urbanized areas. More specifically, “urban” consists of territory,

22

persons, and housing units in places of 2,500 or more persons incorporated as cities, villages,

boroughs (except in Alaska and New York), and towns (except in the New England states, New

York, and Wisconsin).

“Urban” excludes the rural portions of “extended cities”; census designated place of 2,500 or more

persons; and other territory, incorporated or unincorporated, including in urbanized areas.

Secon 2 ‐ Branch Locaons

Shelby County State Bank

Hours of Operation

Harlan Locations

800-574-3531

www.scsbnet.com

Main Bank

Lobby: 508 Cour Street, PO Box 29

Harlan, IA 51537

Phone: 712-755-5112

Monday-Friday 8:00 AM-4:00 PM

Drive-in: Monday - Thursday 8:00 AM - 4:00 PM

Friday - 8:00 AM - 5:00 PM

Census Tract 9604. 00

West Branch

Lobby: 2010 23rd Street

Harlan, Iowa 51537

Phone: 712-755-7671

Monday-Friday 8:00 AM-4:00PM

Drive-in: Monday - Friday 8:00 AM -5:00 PM

Saturday - 8:00 AM - Noon

Census Tract 9603.00

Elm Crest Retirement Community

2104 12

th

Street

Harlan, IA 51537

Phone: 712-755-5174

Hours of Business: no visits are made to this location.

Census Tract 9603.00

Avoca, Iowa

155 S Elm Street

Avoca, Iowa 51521

Phone: 712-307-6670

Lobby

Monday

-

Friday

8:00

AM

-

4:00

PM

Drive-in

Monday

-

Thursday

8:00

AM

-

4:00

PM

Friday

8:00

AM

-

5:00

PM

Census Tract 215.02

Elk Horn, Iowa

4039 Main Street

Elk Horn, Iowa 51531

Phone: 712-764-5067

Lobby & Drive-in:

Monday

-

Thursday

8:00

AM

-

3:30

PM

Friday 8:00 AM

-

5:00 PM

Drive-in

only

Saturday

8:00

AM

-

11:00

AM

Census Tract 9601.00

Panama, Iowa

102 Main Street

Panama, Iowa 51562

Phone: 712-489-2424

Lobby

&

Monday

-

Thursday

8:00

AM

-

3:30

PM

Drive-in:

Friday

8:00

AM

-

4:00

PM

Census

Tract

9602.

00

Portsmouth, Iowa

111Main Street

Portsmouth, IA 51565

Phone: 712-743-2715

Lobby

Monday

-

Thursday

8:00

AM

-

3

:30

PM

&

Drive-in

Friday

8:00

AM

-4:00

PM

Census

Tract

9602.00

Irwin, Iowa

512 Ann Street

Irwin, Iowa 51446

Phone: 712-782-3155

Lobby

Monday

-

Thursday

8:00

AM

-

3:30

PM

Friday

8:00 AM

-

5:00 PM

Census Tract 960 l.00

Shelby, Iowa

425 East Street

Shelby, Iowa 51570

Phone: 712-544-2626

Lobby

Monday

-

Friday 8:00 AM

-

4:00 PM

Drive-in

Monday

-

Thursday 8:00 AM – 4:00 PM

Friday 8:00 AM – 5:00 PM

Saturday 8:00 AM – 11:00 AM

Census Tract 9602.00

Ida Grove, Iowa

200 Moorehead Avenue

Ida Grove, Iowa 51445

Phone: 712-364-3181

Lobby

Monday

-

Thursday

9:00

AM

-

3

:00

PM

Friday

9:00

AM

-

5:00

PM

Drive-in

Monday

-

Friday

8:00

AM

-

5:00

PM

Census Tract 903.00

Battle Creek, Iowa

502 2

nd

Street

Battle Creek, Iowa 51006

Phone: 712-365-4341

Lobby

Monday-

Thursday

9:00

AM

-

3:00

PM

&

Drive-in

Friday

9:00

AM

-

5:00

PM

Census Tract 902.00

Danbury, Iowa

202 Main Street

Danbury, lowa 51019

Phone: 712-883-2161

Lobby

Monday

-

Thursday

9:00

AM

-

3:00

PM

&

Drive-in

Friday 9:00 AM

-

5:00 PM

Census Traci 31.00

Mapleton, Iowa

414 Main Street

Mapleton, Iowa 51034

Phone: 712-881-2161

Lobby

Monday

-

T

h

ursday

9:00

AM

-

3:00

PM

Friday 9:00 AM

-

5:00 PM

Census Tract 9601.00

Odebolt, Iowa

100 S Main Street

Odebolt, IA 51458

Phone: 712-668-2218

Lobby

Monday

-

Thursday

9:00

AM

-

3:00

PM

Friday 9:00 AM

-

5:00 PM

Census Tract 802. 00

Section 3 ‐ Branch Openings and Closings

Branch Openings: Shelby County State Bank merged with First State Bank on February 1, 2022.

Listed are the locations

Ida Grove, Iowa

200 Moorehead Avenue

Ida Grove, Iowa 51445

Phone: 712-364-3181

Lobby

Monday

-

Thursday

9:00

AM

-

3

:00

PM

Friday

9:00

AM

-

5:00

PM

Drive-in

Monday

-

Friday

8:00

AM

-

5:00

PM

Census Tract 903.00

Battle Creek, Iowa

502 2

nd

Street

Battle Creek, Iowa 51006

Phone: 712-365-4341

Lobby

Monday-

Thursday

9:00

AM

-

3:00

PM

&

Drive-in

Friday

9:00

AM

-

5:00

PM

Census Tract 902.00

Danbury, Iowa

202 Main Street

Danbury, lowa 51019

Phone: 712-883-2161

Lobby

Monday

-

Thursday

9:00

AM

-

3:00

PM

&

Drive-in

Friday 9:00 AM

-

5:00 PM

Census Traci 31.00

Mapleton, Iowa

414 Main Street

Mapleton, Iowa 51034

Phone: 712-881-2161

Lobby

Monday

-

T

h

ursday

9:00

AM

-

3:00

PM

Friday 9:00 AM

-

5:00 PM

Census Tract 9601.00

Odebolt, Iowa

100 S Main Street

Odebolt, IA 51458

Phone: 712-668-2218

Lobby

Monday

-

Thursday

9:00

AM

-

3:00

PM

Friday 9:00 AM

-

5:00 PM

Census Tract 802. 00

Closed Branches: N/A

Section4ͲBranchServices

Thissectionincludesproducts,services,and alistingofATMs.

Listing of services generally offered at the bank’s branches – along with any differences by

branch.

Loans

Loan officers are available to match your credit needs to our offering of loan products. We offer

consumer loans for home purchase, refinance and improvement or equity, car loans, personal loans,

and Home Equity Lines of Credit. We also offer commercial business loans and agricultural loans for

operating, equipment/capital purchases and real estate. The bank participates and offers loan

programs through SBA, FSA, IFA First-Time Homebuyers, Long-term Residential mortgages. The

Shelby County State Bank is an equal opportunity lender.

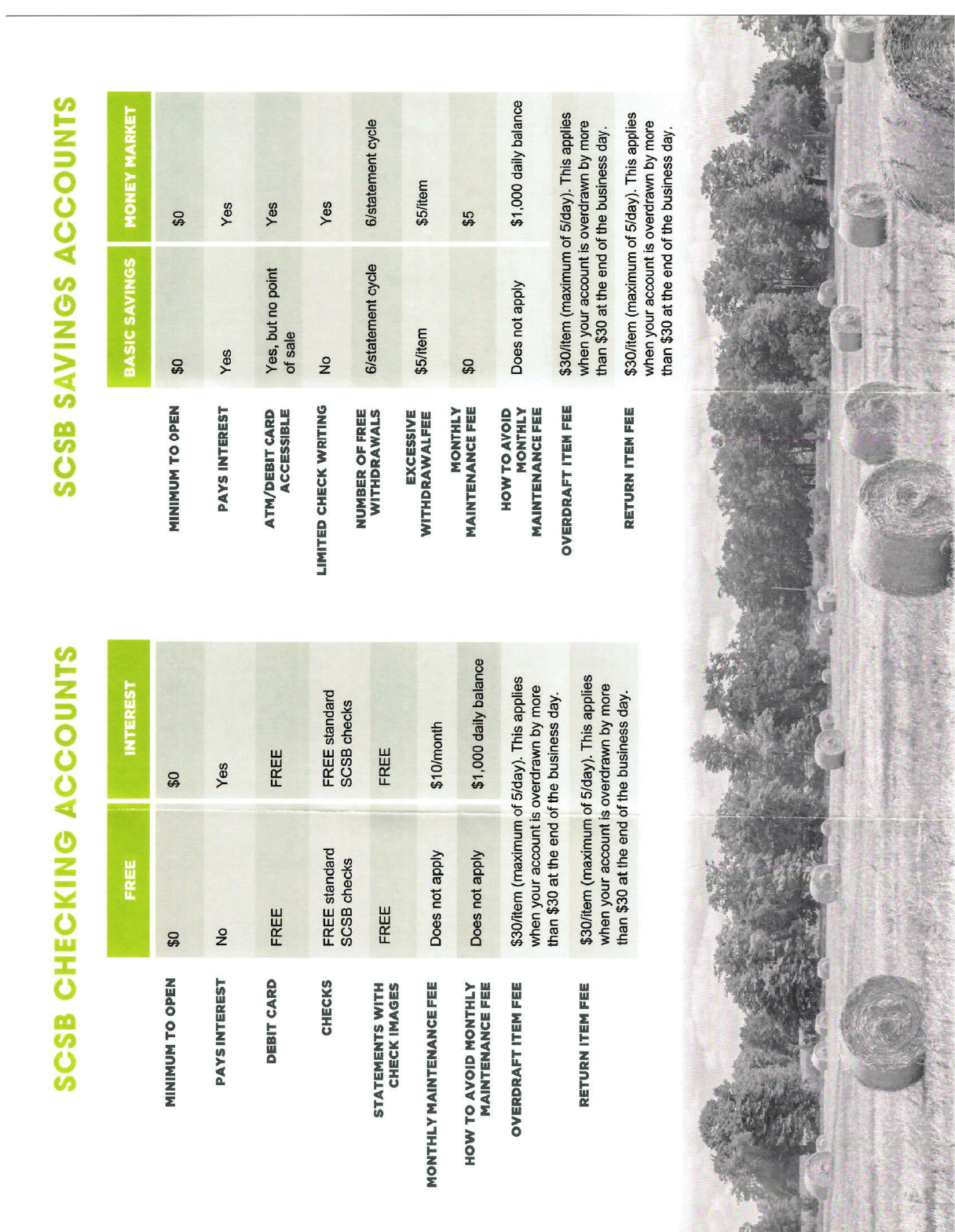

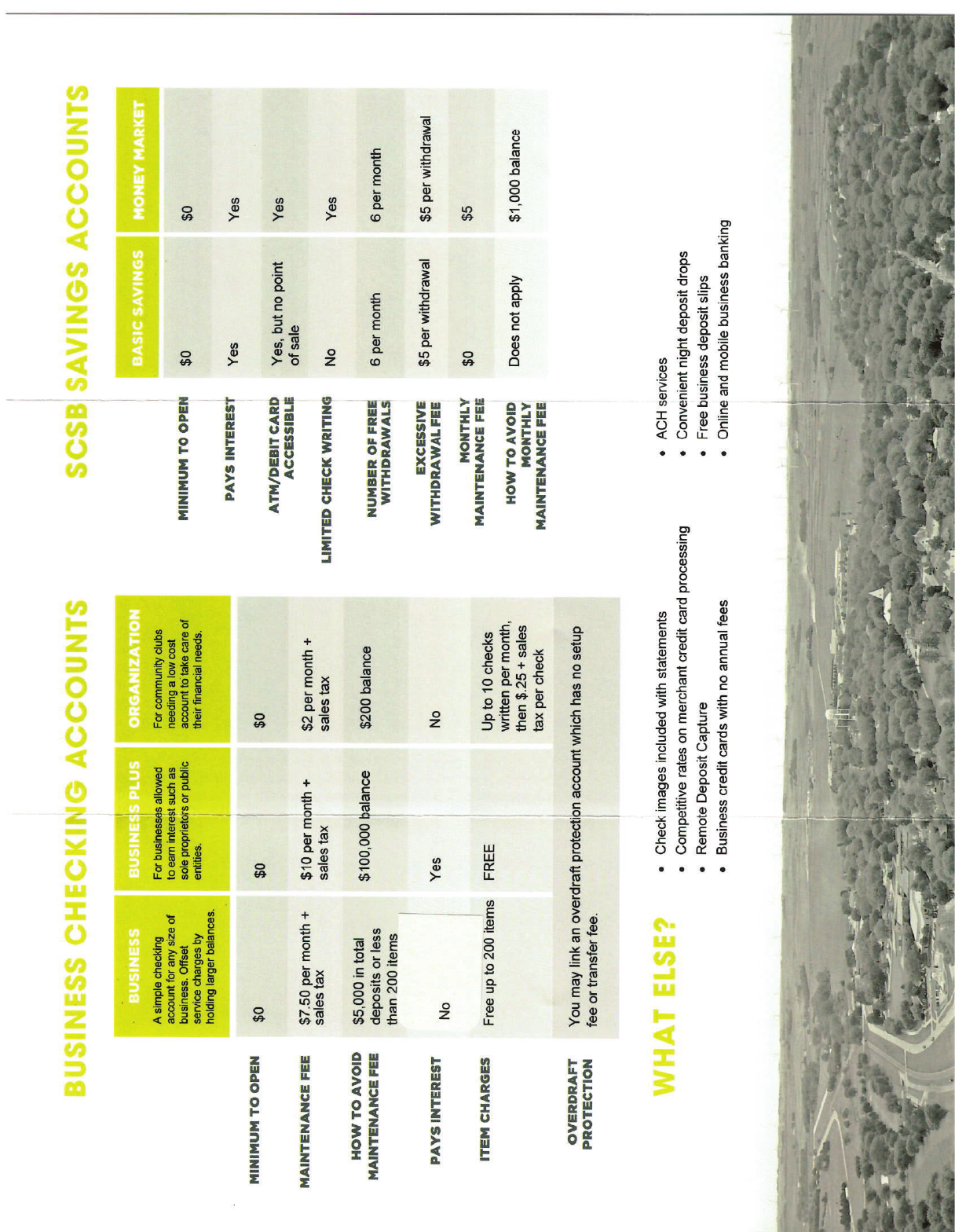

Checking and Savings Accounts

We have various checking and savings accounts available (consumer and business). See attached

Appendix A-3 and A-4 for consumer and business accounts currently available.

IRA, SEP IRA/Simple IRA, Coverdell Savings Accounts, Roth IRA, and Health Savings

Accounts

We can help you save for retirement. Turn a small investment into a sizable amount with tax- sheltered

dollars. Our rates are very competitive and can change quarterly. Please inquire.

Time Certificates of Deposit

We have CDs of various maturities. Rate changes on Certificates of Deposits are effective every

Monday. Watch our specials. Please inquire at our main bank or any branch offices.

Direct Deposit

For your convenience, government, pension, and payroll checks can be directly deposited at the

Shelby County State Bank at no charge.

Commanders Club

If you have reached the age of 55, you are eligible to become a Commander. Commanders enjoy many free or

reduced cost bank services. As a commander you may attend special events and seminars, take trips and tours,

receive the Commanders newsletter and much more. To find out more about our Commanders Club, please

call us at 712-755-5112.

Automated Teller Machines (ATM)

Locations: Main Bank and West Branch in Harlan, Avoca Bank, Elk Horn Bank, Panama Bank, Shelby Bank,

Battle Creek Bank, Danbury Bank, Mapleton Bank, Ida Grove has 2 ATMs located at Food Pride and Cenex.

In Ute the ATM is located at Sparetime Bar and Grill.

SCSB ATM & Debit Cards

We have ATM & Debit Cards for your convenience. These can be used in place of writing a check. It may also

be used as a cash card at the ATM.

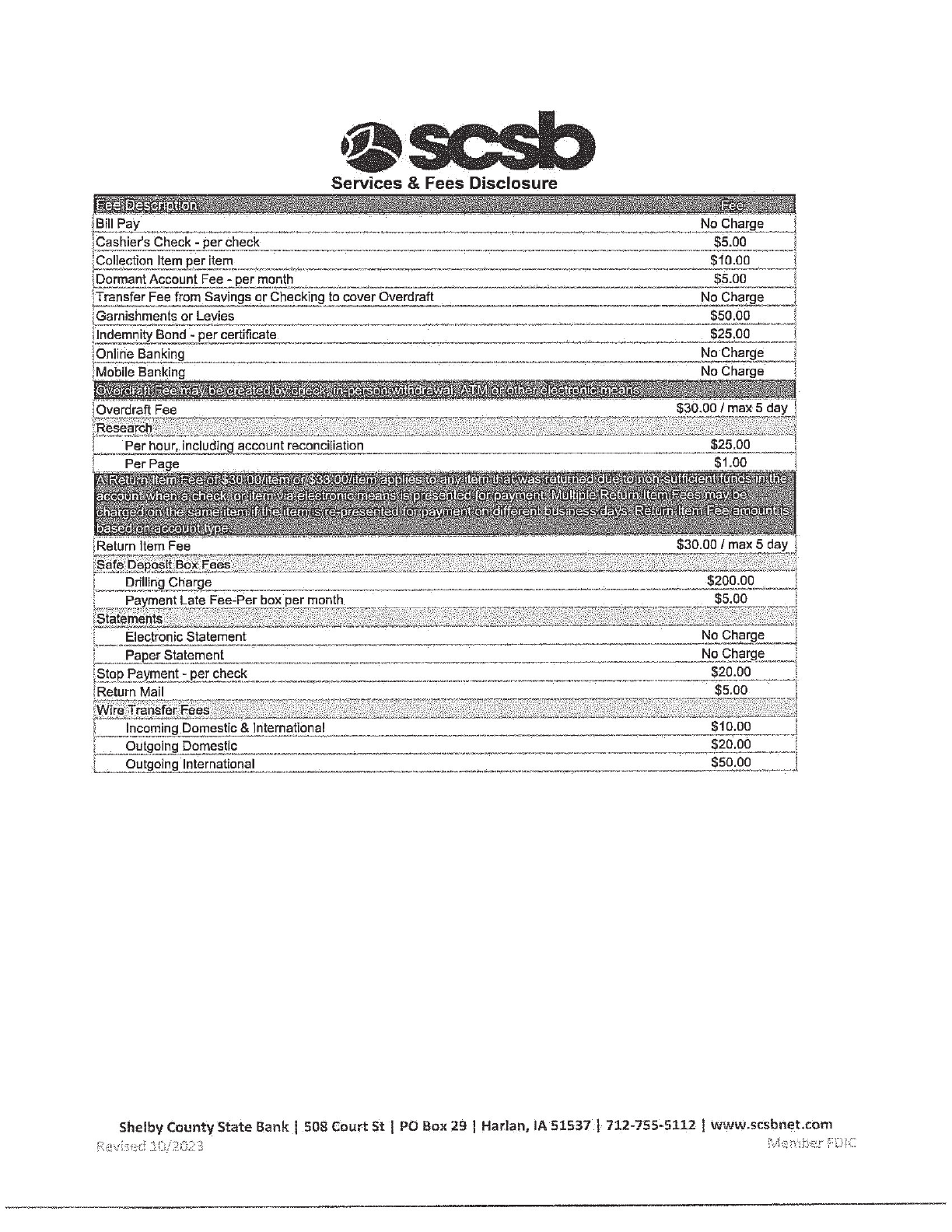

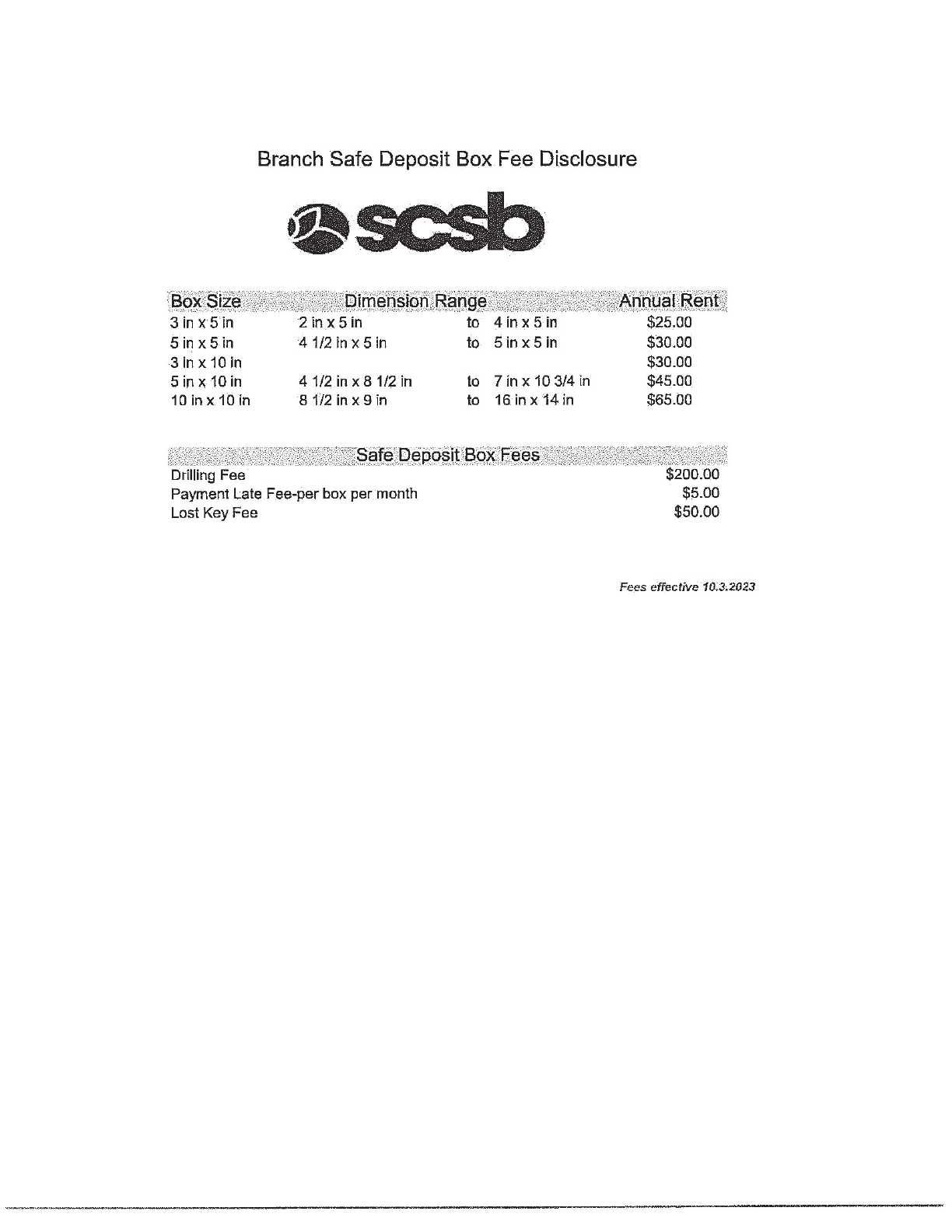

Safety Deposit Boxes

Boxes are available in all branches, except the nursing home. The annual fee and box size are included with the

fee’s worksheet.

Bank by Mail

This service is available at no charge.

Overdraft Protection – Driver Fix

Upon approval, you may set up automatic transfers from one account to another.

FDIC Insurance Protection

Each depositor is insured up to at least $250,000 by Federal Deposit Insurance Corporation (FDIC). Properly

established accounts in individual, joint and trust account ownership can increase your insurance coverage.

Please ask for further details.

XPRESS Banking

A service provided which allows you to bank by telephone 24 hours a day, 365 days a year. Call 712-755-7921

or toll free 888-755-5112 is available for the Harlan, Avoca, Elk Horn, Panama, Portsmouth, Irwin and Shelby

locations.

Night Deposit

A night depository is available at our offices in Harlan the main bank, West Branch, Elk Horn, Panama,

Portsmouth, Irwin, Shelby, Avoca, Ida Grove, Battle Creek, Danbury and Mapleton.

ACH Origination

The Shelby County State Bank has the capability of originating ACH payments, transfers, deposits, and loan

payments. Please inquire at the main bank.

Home Equity Line of Credit/Check Reserve Accounts

You may now protect your checking account from costly overdraft fees with either of these products. Interest

may be tax deductible on the Home Equity Line of Credit. (Consult your accountant for details)

Full Line of Insurance Products

FNIC- Trusted Insurance Advisors is located in the Shelby office offering a full line of Life, Health, Long Term

Care, Auto, Home, Commercial, Farm and Crop Hail.

24 Hour Banker Online

Online banking service, which allows customers (consumer and business) to access all their primary account

relationships with the bank through an internet connection. BillPay allows for payment of bills online, transfer

funds and access account history on banking products.

Mobile Banking

Mobile Banking is a free service available to all customers by downloading the Shelby County State Bank app

on their mobile device. Mobile Banking allows customers to check their deposit account and loan balances and

history, transfer funds, make payments, view and search their transaction history. Customers can receive alerts

via email about account activity and checks can be deposited within the mobile app.

"QQFOEJY"

"QQFOEJY"

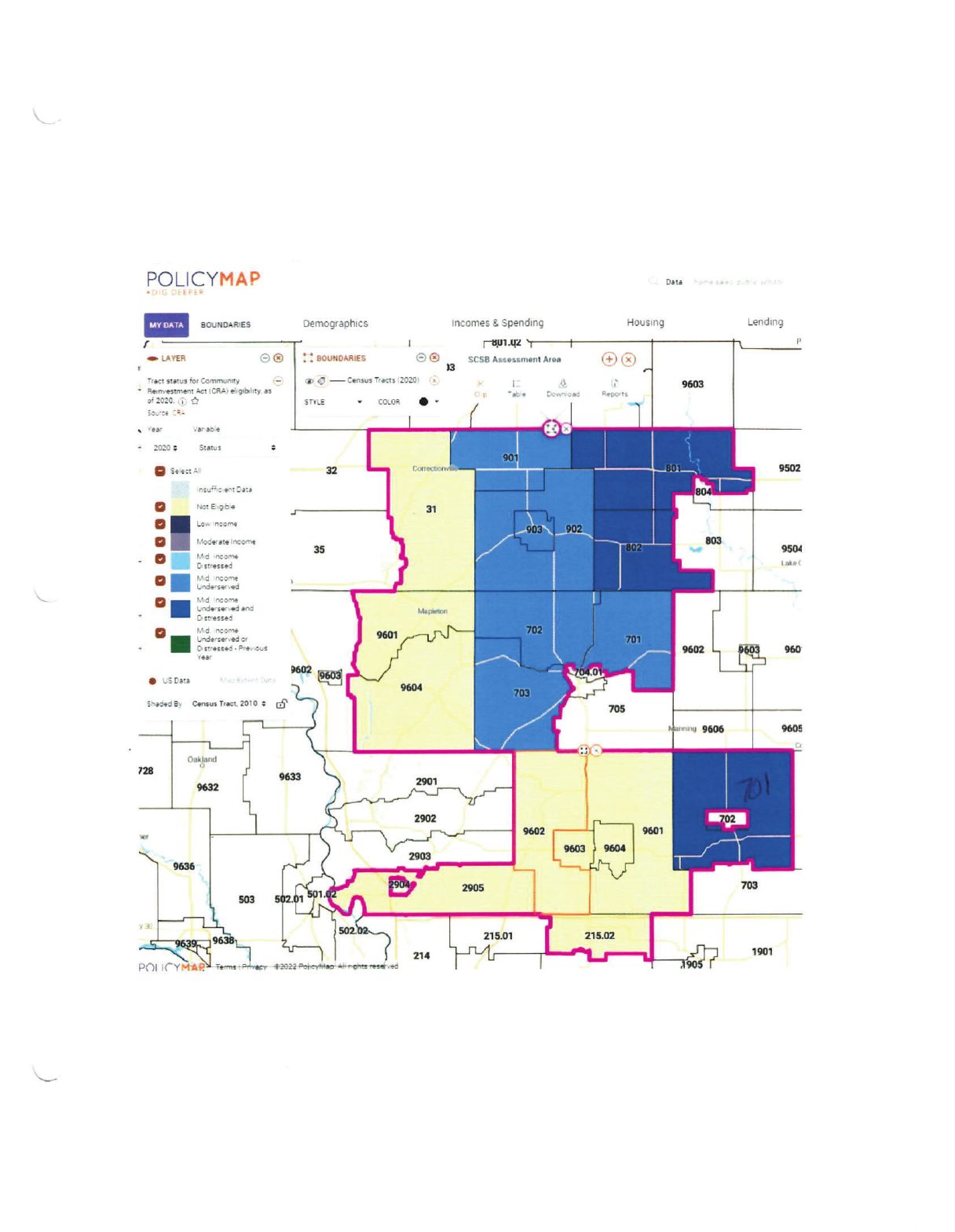

Section5ͲAssessmentAreaMaps

4$4#"TTFTTNFOU"SFB

"QQFOEJY"

Section6Ͳ>ŽĂŶƚŽĞƉŽƐŝƚZĂƚŝŽƐ

2022 Loan/Deposit Ratios

March 31, 2022

$328,965,748

$518,838,008

63.40%

June 30, 2022

$333,292,302

$494,235,851

67.44%

September 30, 2022

$340,451,090

$487,701,417

69.81%

December 31, 2022

$355,557,704

$476,311,841

74.65%

2023 Loan/Deposit Ratios

March 31, 2023

$337,545,559

$485,869,290

69.47%

June 30, 2023

$328,373,026

$471,289,988

69.68%

September 30, 2023

$337,751,982

$477,560,838

70.72%

December 31, 2023

$354,154,372

$472,050,995

75.02%

Section7‐HMDADisclosureStatements

HMDA Disclosure Statements may be obtained on the Consumer Financial Protection Bureau’s Web site

at www.consumerfinance.gov/hmda (http://www.consumerfinance.gov/hmda).

Section8‐PublicComments

Public Comments

Per 12 C.F.R. Part 25.43 (a)(1) the Public File must include all written comments received from the public

for the current year and each of the prior two calendar years that specifically relate to the bank’s

performance in helping to meet community credit needs, and any response to the comments by the bank,

if neither the comments nor the responses contain statements that reflect adversely on the good name or

reputation of any persons other than the bank or publication of which would violate specific provisions of

law;

Shelby County State Bank does not have any written comments from the public for the current year or the

prior two calendar years.