GLOBAL INVESTMENT RESEARCH | July 2016

THE OLYMPICS

AND ECONOMICS

2016

Investors should consider this report as only a single factor in making their investment decision. For

Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to

www.gs.com/research/hedge.html. For a list of authors, please see overleaf.

The Goldman Sachs Group, Inc.

29 July 2016

Page 2

Goldman Sachs

The Olympics and Economics 2016

Table of Contents

Francesco Garzarelli

+44 20 7774-5078

Goldman Sachs International

Kamakshya Trivedi

+44 20 7051-4005

kamakshy[email protected]

Goldman Sachs International

Alberto Ramos

+1 212 357-5768

Goldman, Sachs & Co.

Mark Ozerov

+44 20 7774-1137

mark.ozero[email protected]

Goldman Sachs International

Authors:

Introduction: Modelling Medal Success in Rio 3

Forecasting Olympic Success, Economist Style 4

The Top Olympian: An Economist’s Pick 12

Brazil: Hoping for the Olympic Spirit to Lift the Animal Spirits of the Brazilian Economy 15

Disclosure Appendix 18

Introduction: Modelling Medal Success in Rio

Even economists like to have a little summer fun, at least every four years. In the

quadrennial Olympics and Economics report that follows, we explore the link

between a country’s economic, political and institutional traits and its medal

success, and we update our ever-popular medal predictions model to forecast

country medal counts at the Rio Games. We also explore the economic benefits (if

any) of hosting the Olympics—a question that’s top of mind with the prolonged

contraction in Brazil.

Before we (and the Games) begin, a few fun findings from our analysis:

Hosting is gold. Our model predicts a 30% boost to Brazil’s overall medal tally

n

relative to 2012 and a greater than 50% boost to gold alone—bringing their total

to a record 22.

Just not for the economy. The ~US$10bn spent on infrastructure and logistics isn

too small to stimulate Brazil’s US$1.8 trillion economy.

Or the guy who hosted last time. Expect the UK to lose 10% of its 2012 medaln

tally at the Rio Games, but still end third in the overall medals table.

The key to standing on the podium is sitting down. If you’re the UK, that is.n

Jokes aside, statistics show the country dominates in rowing, cycling and other

seated sports.

There’s an indoor/outdoor factor. The UK and Brazil are among the bestn

outdoor sportsmen, while many Asian countries fare better inside.

Starting something doesn’t mean you’ll finish well. Greece, the birthplace ofn

the Olympics, has poor sporting performance relative to what its economic

indicators suggest it could achieve.

It’s not a two-man race. The US and China dominate in total medals, but not inn

every sport. Whom to watch: Italian fencers, Korean archers and Brazilian

volleyballers.

Now without further ado, we bring you our main event: the 2016 Olympics and

Economics analysis and medal count predictions for Rio. We hope you enjoy reading.

29 July 2016

Page 3

Goldman Sachs

The Olympics and Economics 2016

Forecasting Olympic Success, Economist Style

Four years on from that golden summer of 2012 in London it is time for the summer

Olympics again, this time in the magical city of Rio de Janeiro. Ahead of the London

Games, we undertook a simple exercise to see if we could use macroeconomic

variables and statistical relationships to predict success at the Olympics, mostly to

add to the enjoyment of the event. Looking back, however, the predictions for medal

tallies were more accurate than we could ever have imagined, with the perfect

prediction for the total medals (65) for the UK, and picking 10 out of the top 11

countries in the gold medal tables and all the top 11 in the total medal tables

correctly being the standout highlights.

1.

We would not be good economists (or econometricians) if we did not acknowledge

the role of beginners’ luck or randomness here, typical in small samples. And

without an in-depth knowledge of elite athletes, recent performance metrics, and

event details, it would be surprising if broad econometric exercises based on

macroeconomic relationships weren’t only a very rough guide to predicting Olympic

success. Still, the predictive success of our last effort suggests that at least at the

level of a country it may be possible to identify the ingredients of winning. With that

in mind, but mostly because sporting events are often more enjoyable with some

“skin in the game”, we are making another effort at predicting Olympic medals.

Our model features the quality of growth environments, population, previous success, and

‘host effects’

As a reminder, our medal predictions below are based on a panel regression model

with time effects, where the explanatory variables are our proprietary Growth

Environment Score (GES), the size of the population, lagged medal attainment, a

dummy variable for the host (in this case Brazil) and a dummy variable for the

previous host (in this case the UK). All variables are statistically significant at a 10%

level.

2.

Our Growth Environment Score is a proprietary broad measure of growth conditions

across countries which we have aggregated annually since 1996. They are designed

to capture important features of the economic, political and institutional environment

that affect productivity performance and growth across countries, and we use these

scores to guide our thinking about countries’ long-term potential. Their inclusion in

the model reflects the simple insight that a country is more likely to produce

world class athletes in a world class environment; and while that is hard to

measure in a sporting context, we think our GES scores provide a useful and holistic

measure of a high quality environment that can be related to sporting success in

addition to economic success.

1.

The medal predictions in Gold goes to where growth environment is best – using our GES to predict

Olympic medals, July 2012 also holds up well in more rigourous comparisons

(http://www.topendsports.com/events/summer/medal-tally/predicted-analysis-2012.htm).

2.

Our calculations, forecasts and exhibits exclude Cuba, North Korea and Puerto Rico due to absence of

data on GES scores.

29 July 2016

Page 4

Goldman Sachs

The Olympics and Economics 2016

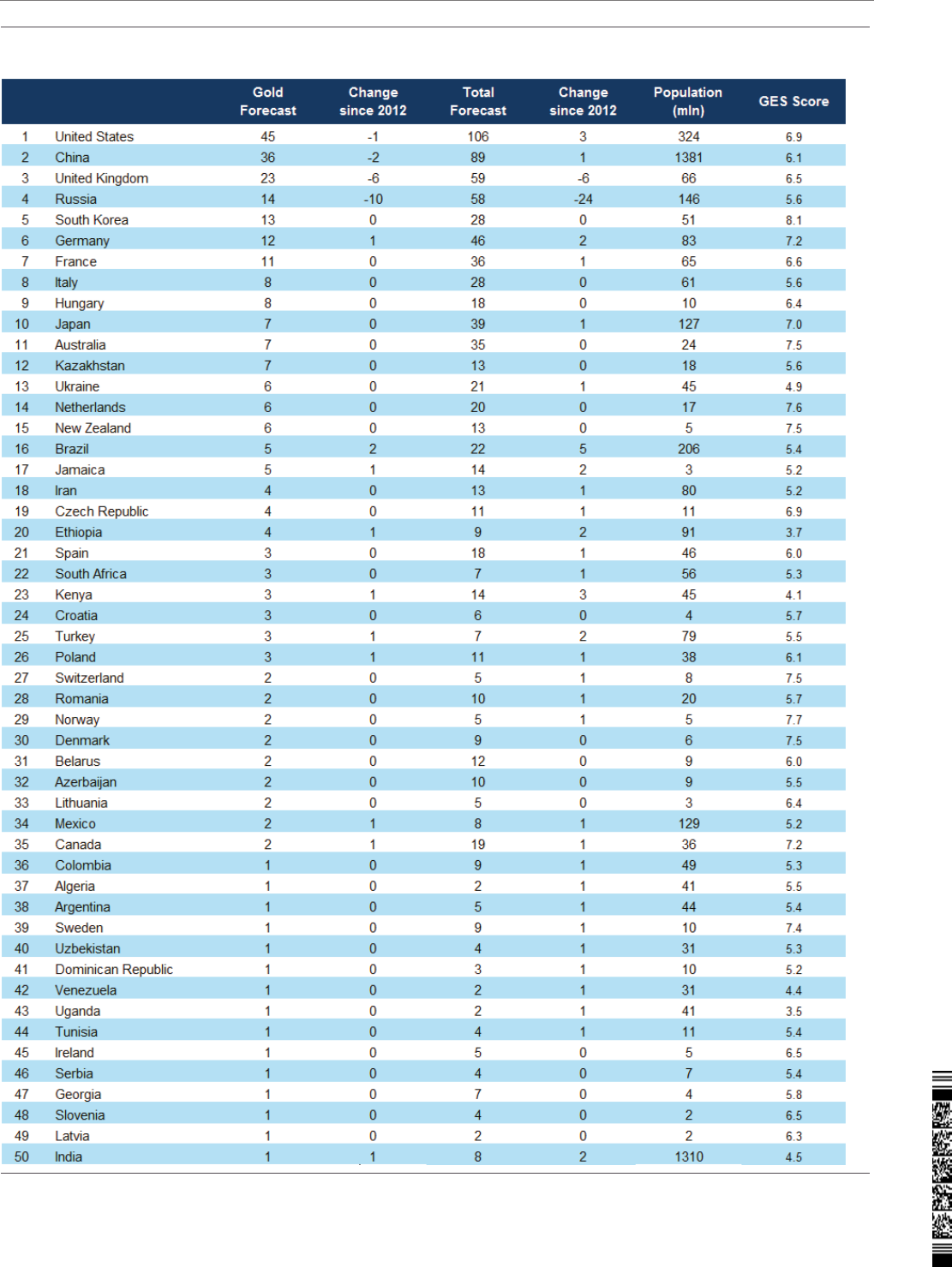

There are two main differences compared to the model we used in 2012. First, there

is typically a significant boost to medal attainment that comes from hosting the

Olympic Games – according to our model estimates a roughly 50% boost in terms

of gold medals and a 20% boost to the total medal tally. Previously we had modelled

this in absolute units of medals, whereas now we uprate the host tally (in this case

Brazil) by a percentage increment relative to the previous Games. As Exhibit 2

shows, the UK gained 50% more golds in 2012 relative to the previous Games in

2008. Second, some of our most significant forecast misses in our previous

prediction exercise came in countries that were recent Olympic hosts and where we

forecast a much stronger performance than eventually achieved. In other words,

what the host effect giveth, it also taketh away. For example, Australia’s total medal

tally has been sliding since the outstanding performance at the Sydney Games of

2004 (with 58 medals), and similarly China, with 88 total medals at London 2012

underperformed our prediction of 98 total medals relative to the 100 achieved in the

Beijing 2008 Games. Our estimates suggest that previous hosts (in this case the UK)

lose roughly 10% of their overall medal tally and 15% of their gold medal tally at the

next Games.

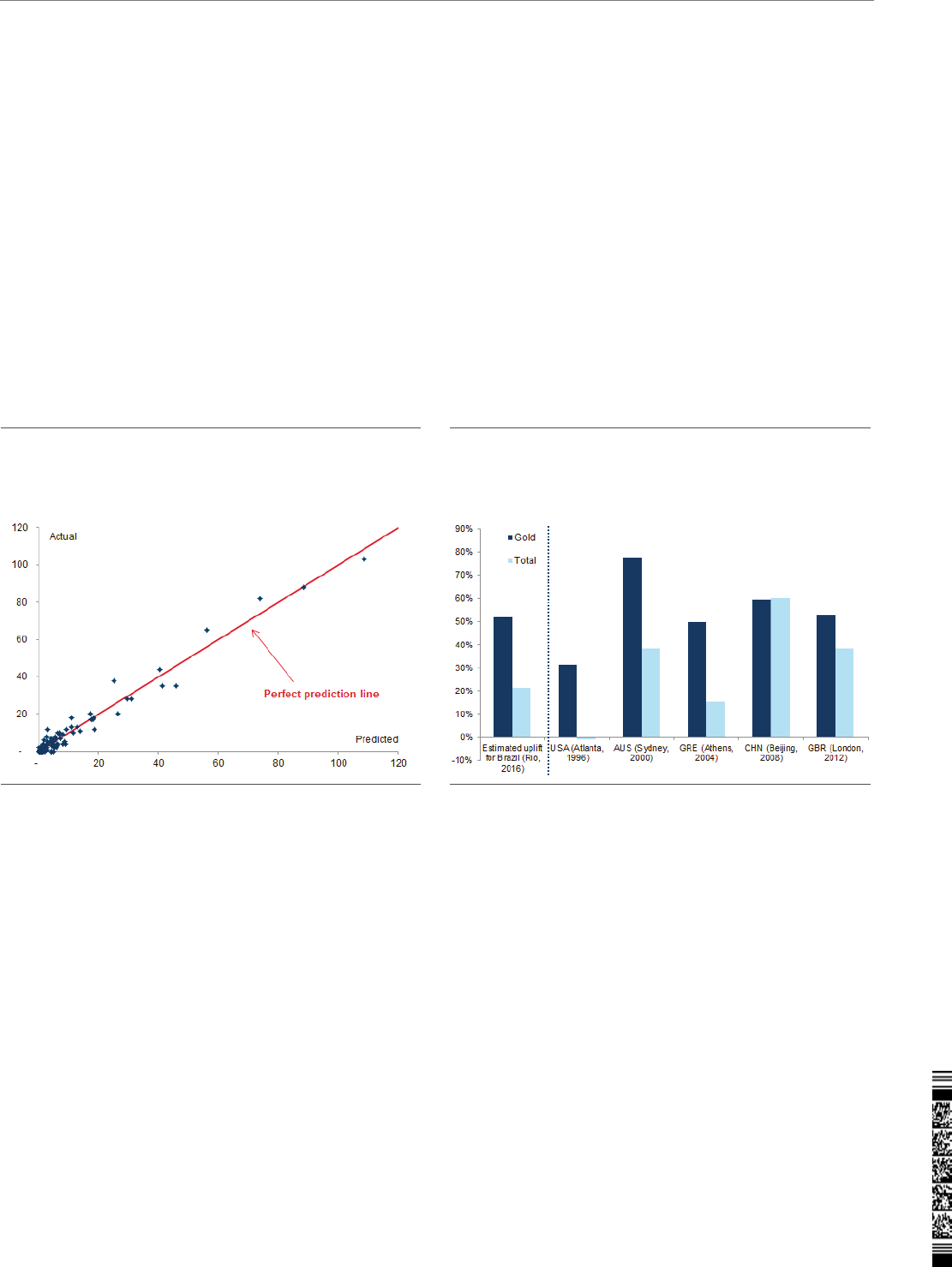

In general, the model explains roughly 90% of the variation in medal attainment over

the past 5 Olympic Games and is better at predicting total medals relative to gold

medals – unsurprising given that the difference between winning a gold (versus

silver or bronze) comes down to one-hundredth or one-thousandth of a second. The

predictive performance of the model for the 2012 Games can be seen in Exhibit 1.

The 45 degree line represents a perfect forecast and the fact that most points

(representing total medal attainment by country) are close to that line suggests a

high degree of forecast accuracy.

One final caveat about the estimation and then we can dive into the medal

predictions. The ongoing controversy about Russia’s participation in the Rio Olympics

is especially hard for our modelling approach to incorporate. Moreover, since Russia

typically is among the top 5 medal winners, this can have significant knock-on effect

on the rest of the predictions in a way that the non-participation of a smaller country

would not. Based on the information available at the time of going to print – that

Russia is unlikely to participate in Athletic events and only partially in a range of other

Olympic sports – we subtract the share of medals that Russia won in these specific

competitions in the London 2012 Games from its 2016 prediction, and redistribute

those medals to the rest of the countries in line with their 2012 Athletics medal

achievements. We recognise the crudeness of this approach, which is likely to affect

the accuracy of the final medal predictions, but it is the most straightforward

adjustment under the current circumstances.

29 July 2016

Page 5

Goldman Sachs

The Olympics and Economics 2016

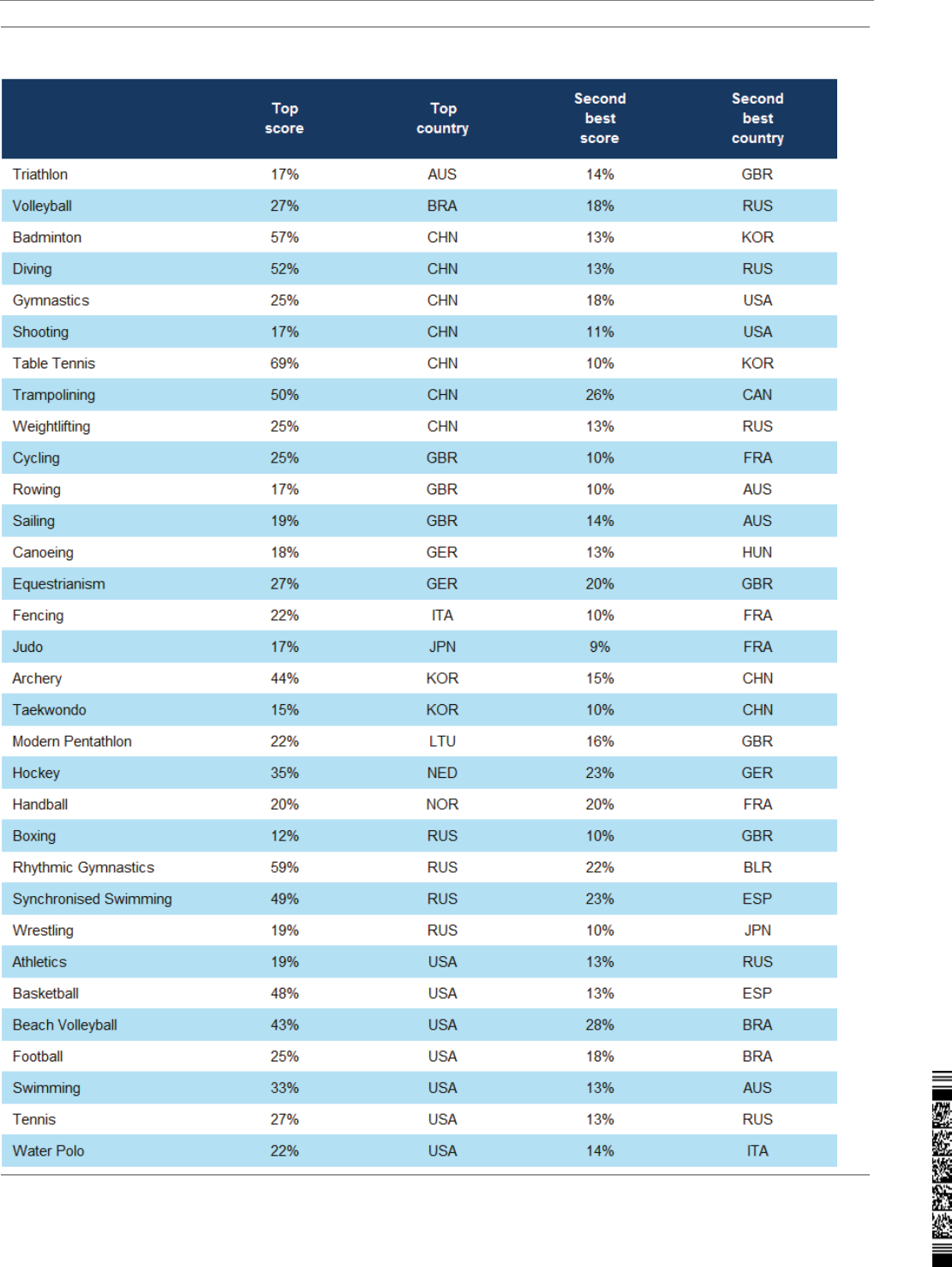

Exhibit 3 presents our predictions for gold medals and Total medals for 2016. They

reveal that in general, gold does go to where the growth environment is best –

countries with better GES scores and higher populations tend to get the most

medals. In terms of changes relative to 2012, three things stand out.

F

irst, showcasing the host effect, we expect Brazil to get 22 medals in total – its

n

b

est achievement at the Summer Games ever – and 5 gold medals – equalling its

tally at the 2004 Athens Olympics.

Second, the biggest drops in predicted medal attainment occur in Russia – for the

n

reasons discussed above – and in the UK – as the host effect starts to fade.

Third, we expect to see a small amount of democratisation of the Olympic leaguen

table, with a number of smaller countries improving their performance relative to

2012 at the expense of the traditional Olympic heavyweights who dominate

medal attainment at the top of the table.

Exhibit 1: Our econometric model did a good job in predicting total

medal outcomes in 2012

Dots represent countries’ actual 2012 medal count against the model

prediction

Exhibit 2: A significant and measurable “host effect” at Olympic

Games should benefit Brazil at Rio 2016

Percentage increase in the medal count of host countries relative to the

prior Olympic Games

Source: Sports Reference, Goldman Sachs Global Investment Research Source: Sports Reference, Goldman Sachs Global Investment Research

29 July 2016

Page 6

Goldman Sachs

The Olympics and Economics 2016

Exhibit 3: 2016 Olympics medal count prediction

Forecasts and exhibits exclude Cuba, North Korea and Puerto Rico due to absence of data on GES scores.

Source: Sports Reference, Haver Analytics, Goldman Sachs Global Investment Research

29 July 2016

Page 7

Goldman Sachs

The Olympics and Economics 2016

Sporting dominance – which are the countries to beat at each Olympic sport?

Our predictions for medal attainment at the Rio 2016 Olympics are based on a top

down approach using a parsimonious model. But even if such a model cannot

predict success at the level of each sport, it is still interesting to know which

countries are the best at each Olympic sport.

To address this question, we construct a dominance score for each sport and

country using historical data on medal attainment. We do this calculation in three

steps: first, we calculate a medal attainment per country per sport per year index by

assigning three points to every gold medal, two points to every silver medal and one

point to bronze; second, we calculate a decaying moving average of this index (with

the highest weight given to the most recent (London) Games, and rapidly decreasing

weights thereafter)

3.

; finally, we express the dominance index as a percentage of

total medal scores for each sport, so that we can compare the index across sports

with different number of events.The value of the index ranges between 0% (a

country did not receive any medal in a particular sport over the last 5 Olympic

Games) to 100% (a country received all medals in the particular sport).

The resulting table of sporting dominance is presented in Exhibit 4. A few interesting

observations stand out.

China is very dominant in the sports that it dominates. China has some ofn

the highest dominance scores across all the sports. In other words, it has the

largest margin of leadership in the sports it is best at: for example, China boasts

69% domination in table tennis, 57% in badminton and 52% in diving.

US dominates sports with the largest medal hauls on offer. Unsurprisingly,n

the US and China dominate the dominance table, but there is an important

difference. While US dominance is not as overwhelming as Chinese dominance,

it is focused on sports with the most events and medals on offer, namely

swimming and athletics.

Beware of Italian Fencers, Korean Archers and Brazilian Volleyballers. It is notn

just the Olympic giants (China and the US) that dominate all the sports. With a

dominance score of 44%, South Korean archers have been the team to beat for

several Olympic Games (South Korea also dominates taekwondo but by a much

smaller margin). Similarly, Italian fencers – excuse the bad pun – have been at the

cutting edge of the sport for many Games. And host Brazil has been dominating

the volleyball competition over the last couple of Olympic Games.

Jokes apart, the UK does in fact dominate sports that involve sitting down.n

It is often said in jest that the UK is only good at sports that involve sitting down,

but our dominance scores show that there is firm statistical basis for this claim. It

is dominant in rowing, cycling, sailing and second most dominant in

equestrianism behind Germany.

3.

Medal attainment at the 2012 games are given a 0.5 weight; subsequent games are weighted 0.3 (for

2008), 0.1 (for 2004), 0.05 (for 2000), and 0.05 (for 1996).

29 July 2016

Page 8

Goldman Sachs

The Olympics and Economics 2016

Exhibit 4: Country dominance score by Olympic sport

Scores represent countries’ medal attainment as a proportion of total, with greater weights on recent Games and gold. See text for details.

Source: Sports Reference, Goldman Sachs Global Investment Research

29 July 2016

Page 9

Goldman Sachs

The Olympics and Economics 2016

Catching up, forging ahead, neck and neck, and falling behind

The process by which countries experience income growth, catch-up with the

technological frontier or fall behind is one of the central issues that economists try to

address. One of the seminal articles about this was published almost exactly 30

years ago in the summer of 1986, titled “Catching Up, Forging Ahead, and Falling

Behind” in the Journal of Economic History.

4

.

While the author was interested in

countries catching up or forging ahead in income and productivity terms, the same

process is also ongoing across Olympic sports. Below we highlight four examples of

this:

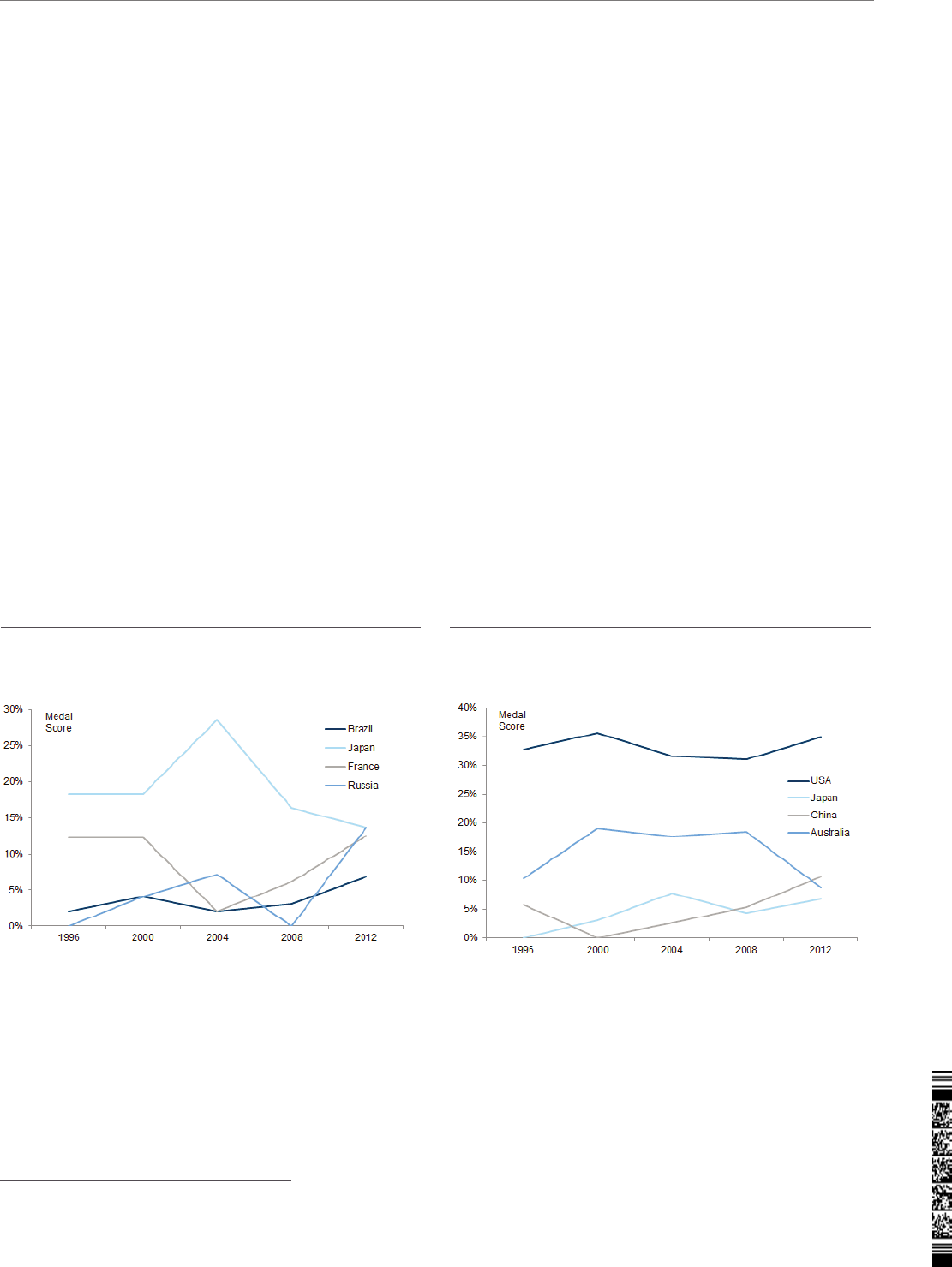

Catching up in judo: While Japan has been the dominant country in terms ofn

medal attainment in judo, this dominance has faded markedly over the past two

Olympic Games. A group of countries have been eating away at its dominance,

including France, Russia and also hosts Brazil. Will the ‘host effect’ help Brazil

leapfrog the other two?

Forging ahead in swimming: The dominance of the US in swimmingn

competitions has grown stronger over the past two Games, in particular at the

expense of Australia. Chinese swimming has been getting consistently better in

the last few competitions, but it is still significantly behind the US in terms of

medal attainment. With some of the largest medal hauls available in swimming, if

the US continues to forge ahead, it will only strengthen its hold at the top of the

overall medals table in Rio 2016.

4.

Abramovitz Moses, Journal of Economic History, June 1986.

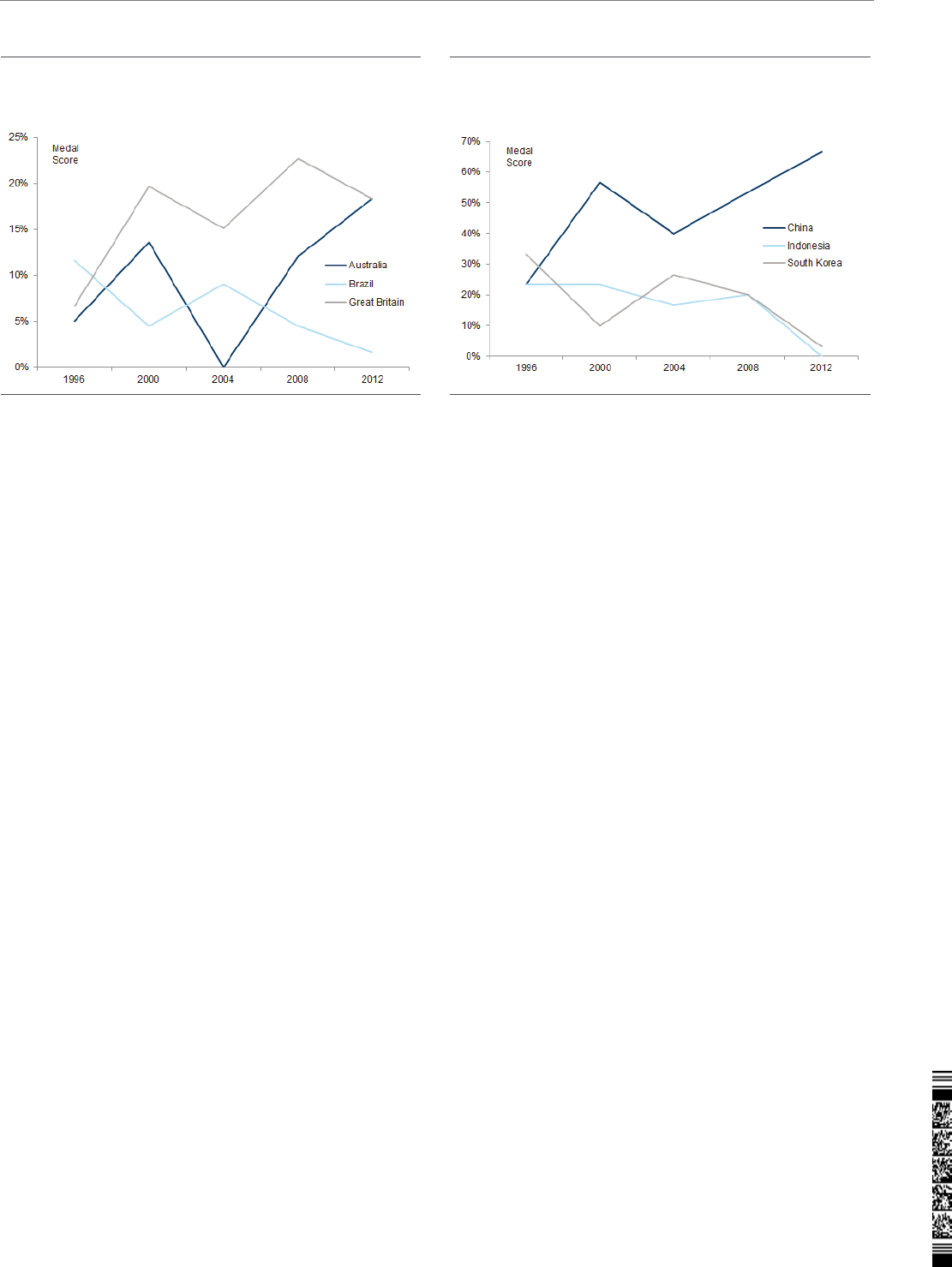

Exhibit 5: Catching up in judo

Scores represent countries’ medal attainment as a proportion of total,

with greater weights on gold.

Exhibit 6: Forging ahead in swimming

Scores represent countries’ medal attainment as a proportion of total,

with greater weights on gold.

Source: Sports Reference, Goldman Sachs Global Investment Research Source: Sports Reference, Goldman Sachs Global Investment Research

29 July 2016

Page 10

Goldman Sachs

The Olympics and Economics 2016

Neck and neck in sailing: Great Britain and Australia are two sailingn

heavyweights and were locked neck and neck in terms of sailing medals

achievement at the last Olympic Games. It will be exciting to see if one of them

manages to edge in front of the other in Rio 2016. Brazil has also been a

formidable competitor here in the past, and while the ‘host effect’ manifests

itself in many different ways, knowledge of local wind and sea conditions may be

a vital advantage.

Falling behind in badminton: The Chinese contingent are likely to dominaten

badminton at Rio 2016, but in part that is because strong competitors from

previous Olympic Games – Indonesia and South Korea – have fallen meaningfully

behind. London 2012 saw their worst performance in the past five Games, and it

will be interesting to see if they can start reversing this at Rio 2016.

Let the Games begin!

Kamakshya Trivedi and Mark Ozerov

Exhibit 7: Neck and neck in sailing

Scores represent countries’ medal attainment as a proportion of total,

with greater weights on gold.

Exhibit 8: Falling behind in badminton

Scores represent countries’ medal attainment as a proportion of total,

with greater weights on gold

Source: Sports Reference, Goldman Sachs Global Investment Research Source: Sports Reference , Goldman Sachs Global Investment Research

29 July 2016

Page 11

Goldman Sachs

The Olympics and Economics 2016

The Top Olympian: An Economist’s Pick

Just like people, some countries are more ‘sporty’ than others. To qualify this

statement, we look at the share of Olympic medals (over the total contested) won

by each country participating in the Games between 1980 and 2012. We then

measure the relative performance of countries controlling for how populous, rich

(income per capita), and ‘efficiently run’ they are. Efficiency here is defined via a

series of economic, political and institutional traits captured by our proprietary

Growth Environment Scores (GES). We also account for a ‘host country’ effect.

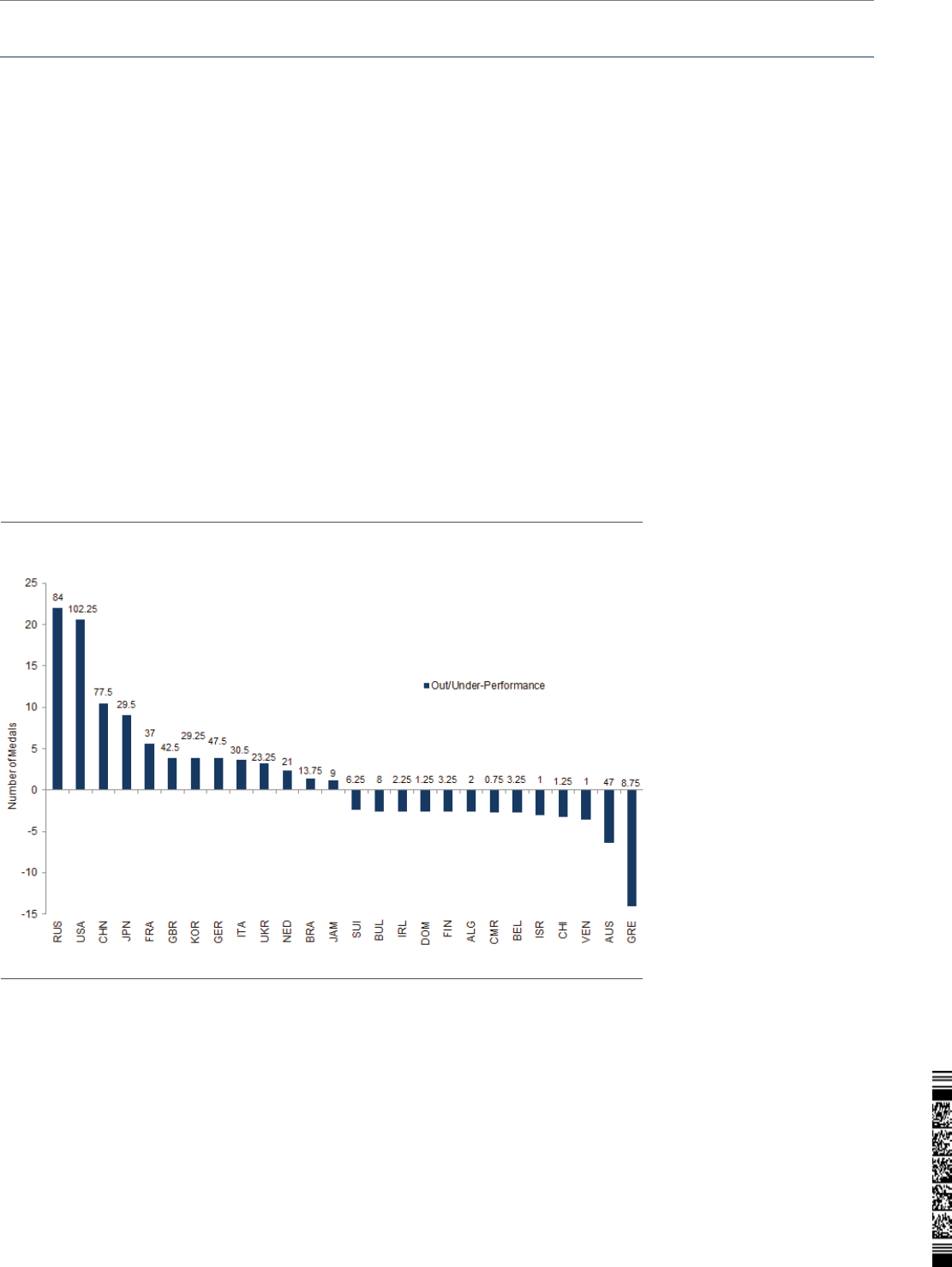

The accompanying chart ranks the 10 top and the 10 bottom countries in all sports

disciplines once the controls mentioned above are applied. Columns are labelled

with the average number of medals won by the country between 2000 and 2012.

Countries which have conquered less than three medals over the past 4 summer

Olympics have been excluded. As can be seen, among all countries taking part in the

Olympics, US, China and Russia appear to be punching above their weight,

especially over the past 4 editions of the Games. By contrast, Greece, Australia,

Venezuela, in particular, have a poor sporting performance in relation to what

economic indicators say they could achieve.

We then look at top and bottom performers among the Euro area countries. Being a

more homogeneous bunch (given their shared institutions), this may enhance the

statistical quality of the results. Among this group of countries, controlling for their

population, income and broader efficiency, the top country in terms of physical

sporting prowess is France, followed by Netherlands and Italy. Greece – birthplace of

the Olympics – is instead lagging behind.

Exhibit 9: China, Russia, US Punch Above Their (Macro) Weight

Country out/underperformance relative to predicted medal count (2000-12 average)

Source: Sports Reference, Haver Analytics, Goldman Sachs Global Investment Research

29 July 2016

Page 12

Goldman Sachs

The Olympics and Economics 2016

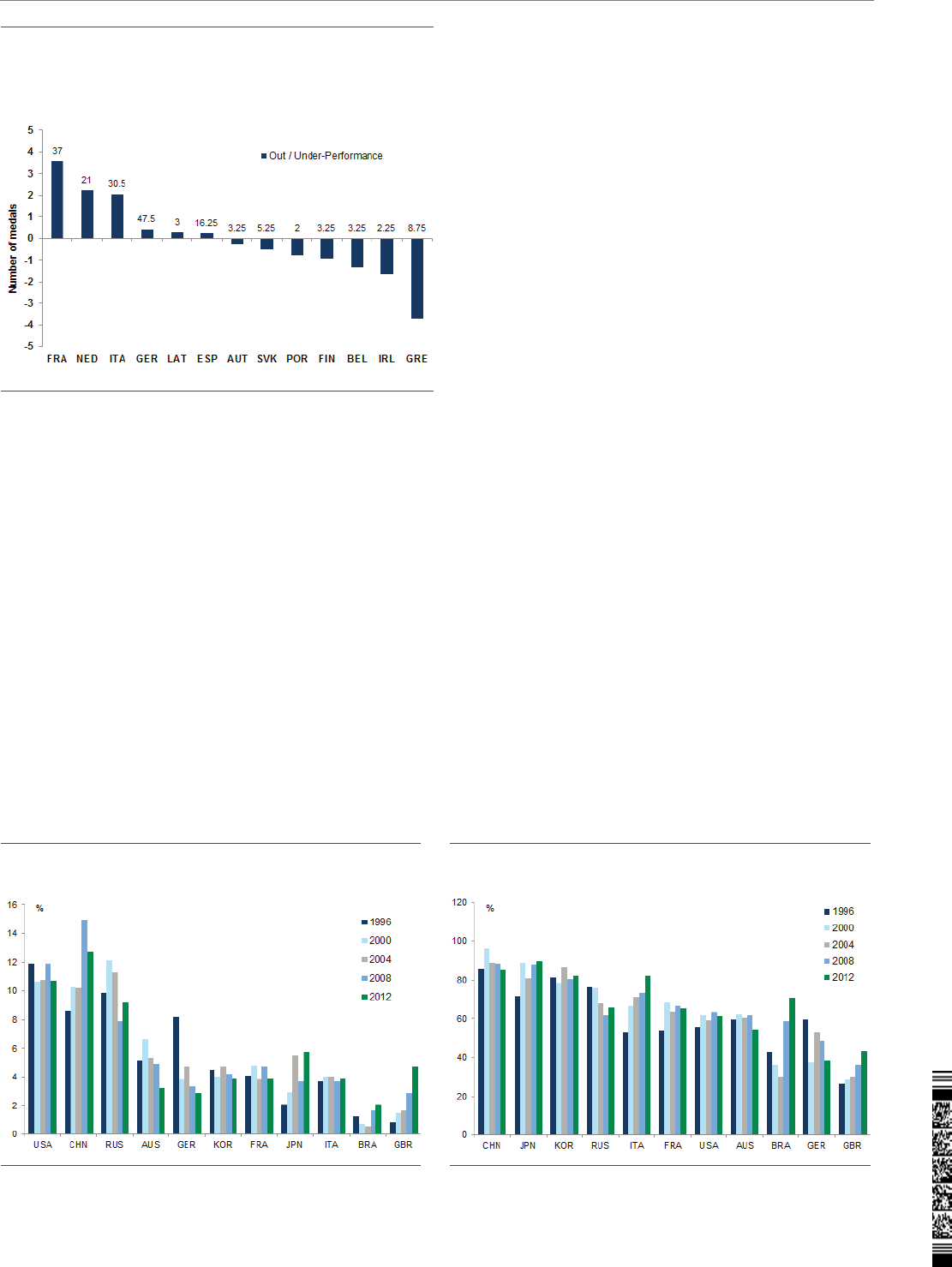

Olympic athletes: Indoor or outdoor types?

Some countries are more successful than others at indoor disciplines, while some

excel in open air activities. To track this, we count the number of medals each

country has won in indoor sports as share of total medal count in indoor sports for

all countries since the 1996 Olympic Games.

In this context, some countries are more ‘specialized’ in indoor disciplines. We look

at the medal count in indoor disciplines as share of total medals won by each

country. As can be seen in the chart below, in China, Japan and Korea athletes seem

to perform better in indoor sports than outdoor ones. By contrast, the most outdoor

sportsmen appear to be those of the UK, Brazil and Germany.

Some countries are better fighters: in boxing, wrestling, judo and taekwondo, most

medals are won by Asian countries. Japan appears to be a specialist: on average

51% of its medals are in these four Olympic disciplines.

Exhibit 10: France, Netherlands and Italy the More Sporty Among

EMU Countries

Country out/underperformance relative to predicted medal count (2000-12

average)

Source: Sports Reference, Haver Analytics, Goldman Sachs Global Investment Research

Exhibit 11: Country medals in indoor sports as a percentage of total

medals in indoor sports (1996-2012)

Exhibit 12: Country medals in indoor sports as a percentage of total

country medals (1996-2012)

Source: Sports Reference, Goldman Sachs Global Investment Research Source: Sports Reference, Goldman Sachs Global Investment Research

29 July 2016

Page 13

Goldman Sachs

The Olympics and Economics 2016

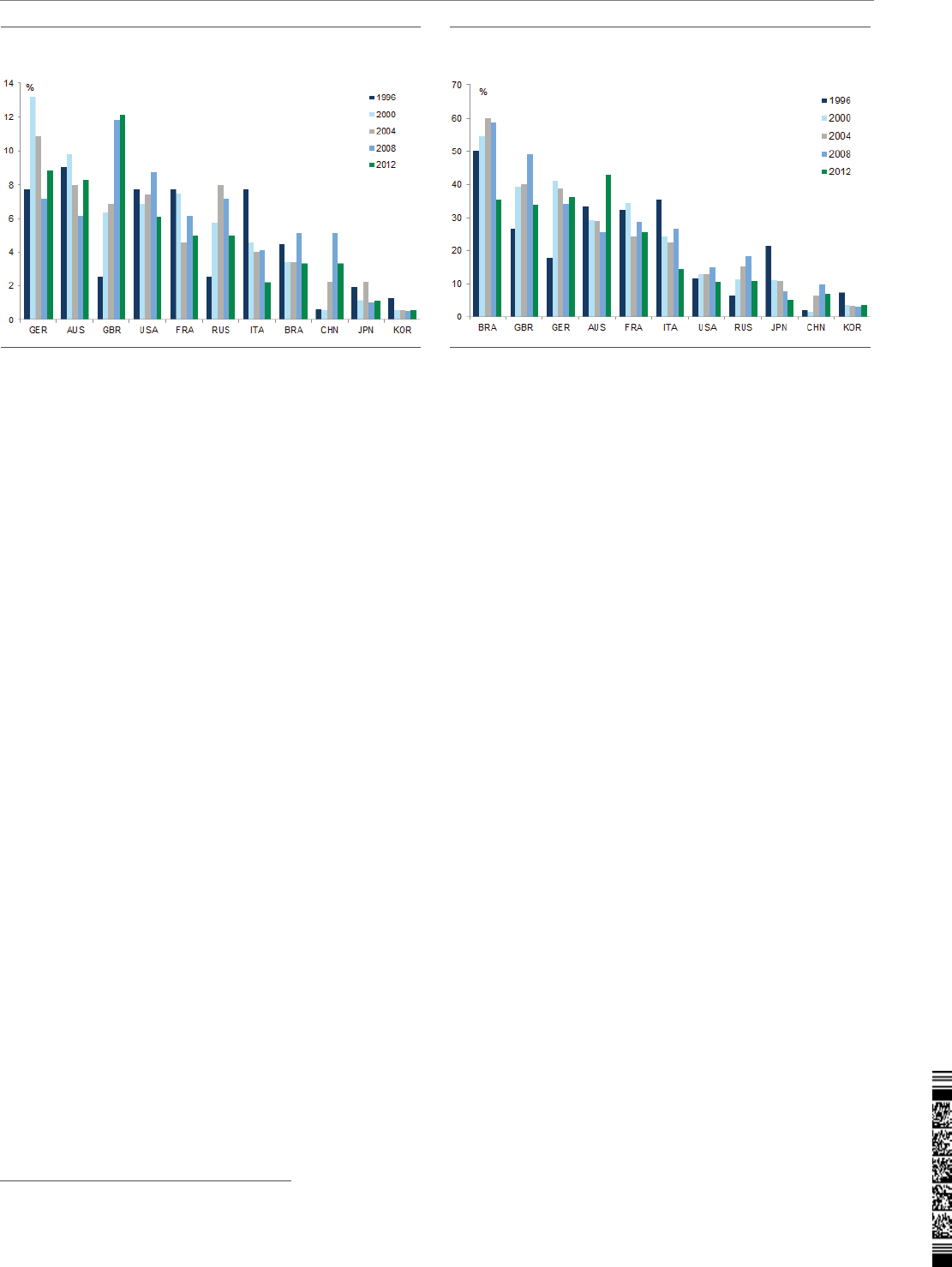

Team-oriented or individualist athletes?

Some countries fare better at team sports than others. In relation to the total medal

count in team sports, Germany excels, followed by Australia and Great Britain. At the

other extreme are the large Asian countries like China, Japan and South Korea.

Brazil’s medal count, however, has historically been dominated by team sports,

representing more than 50% of its medals in the last 5 Olympic Games. At the other

end remain the Asian countries where individual performance appears to prevail.

Francesco Garzarelli and Lorenzo Incoronato

5

.

5.

Lorenzo Incoronato is an intern in the Global Macro Markets team.

Exhibit 13: Country medals in team sports as a percentage of total

medals in team sports (1996-2012)

Exhibit 14: Country medals in team sports as a percentage of total

country medals (1996-2012)

S

ource: Sports Reference, Goldman Sachs Global Investment Research

S

ource: Sports Reference, Goldman Sachs Global Investment Research

29 July 2016

Page 14

Goldman Sachs

The Olympics and Economics 2016

Brazil: Hoping for the Olympic Spirit to Lift the Animal Spirits of

the Brazilian Economy

“The important thing in life is not the triumph but the struggle, the essential thing is

not to have conquered but to have fought well.”

Pierre de Frédy, Baron de Coubertin (Jan 1863 – Sept 1937); French educator,

historian, and founder of the International Olympic Committee.

The glamour of Rio awaits visitors and athletes

The Rio 2016 Summer Olympic and Paralympic Games will be held in Rio de Janeiro,

Brazil. This is the first time a South American country will host the Olympics, and the

first time in a Latin American country since Mexico City in 1968. From Aug 5-21

(Sept 7-18 for the Paralympic Games) more than 10,000 athletes from 206

delegations will celebrate the spirit of the Olympics and compete at the highest level

in 42 different sport disciplines.

Rio de Janeiro is the second largest city in Brazil (with a population of just over 6mn)

and the most popular tourist destination in South America. Rio is known for its

striking natural setting in the Guanabara Bay, sandy beaches, carnival celebrations, a

diverse musical heritage and, of course, its passion for soccer and beach volleyball.

Rio became a World Heritage Site in July 2012: the first city to receive this title from

UNESCO in the Natural Landscape category.

At the 2012 London Olympics, Brazil collected 17 medals (three of which were gold).

Brazil has excelled in volleyball in Olympic competition: its women’s team won gold

and the men’s team silver in London, as well as silver (men) and bronze (women) in

beach volleyball. Brazil is one of the top 10 world economies in US Dollar-

denominated GDP terms (PPP-adjusted), and the fifth largest country in terms of

land mass and population, but finished only in 22nd place (behind Spain) in the total

medal count in London. As has been the experience in other hosting nations, Brazil

hopes to benefit in 2016 from the home Olympic dividend and collect a number of

medals that is more in line with its relative economic weight in the world.

Investment related to the Games too small to lift a large economy

The Olympics are always a time of hope and good feelings. It is a unique opportunity

to celebrate cultural diversity and friendly athletic competition. But these are not the

happiest of times in Brazil as the economy is going through one of the longest and

deepest economic contractions in recorded history, the unemployment rate has

surged to double digits, and federal and local governments are grappling with

deteriorating public finances.

Hosting the 2014 FIFA Soccer World Cup and the upcoming 2016 Summer

Olympic/Paralympic Games increased private and public investment in infrastructure

and related logistics. Investment related to the Games can be divided in three main

buckets. The first is the (operating) cost to actually run the event. This is estimated,

according to official sources, at under R$8bn (US$2.4bn) and will be 100%

sourced/funded by the private sector, including sponsors. The second bucket

29 July 2016

Page 15

Goldman Sachs

The Olympics and Economics 2016

includes investment/expenses related to sports facilities and other projects that

would not have been undertaken if Rio had not hosted the event. These investments

are officially estimated to exceed R$7bn (US$2.1bn), of which roughly 60% will be

funded by the private sector. The third bucket includes projects that either anticipate

or increase federal, state and municipal investments in infrastructure and public

policy programs (e.g., expansion of subway lines). The goal is to increase the number

of people benefitted by the Games. Many of these investments have been funded

through public-private partnerships (PPPs) and are estimated by government sources

to reach approximately R$25bn (US$7.6bn) with roughly 40% of the cost funded by

private sector sources.

Overall, we believe the World Cup and Olympics related investment was just too

small to generate a significant economic dividend/impulse given the sheer size of

the economy (≈ US$1.8 trillion). Furthermore, due to a number of large

macroeconomic imbalances that have grown and permeated the economy and the

severe drop in confidence indicators, total investment spending has actually been

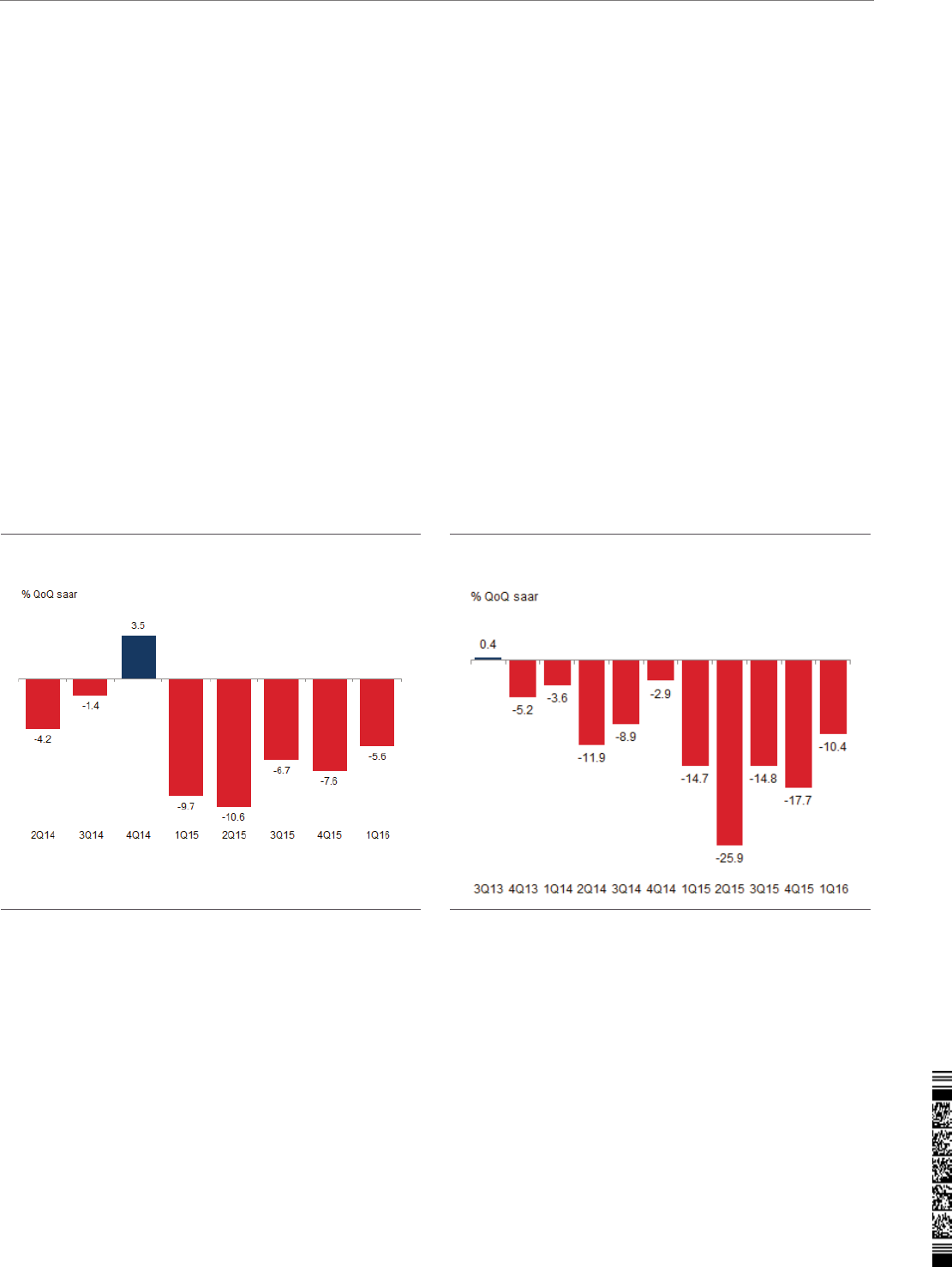

contracting uninterruptedly for 2.5 years. Gross Fixed Investment has now declined

for ten consecutive quarters (at a significantly high average rate of -11.6% qoq sa,

annualized). Overall, gross fixed investment retrenched by a cumulative 27.0%

between 4Q2013 and 1Q2016, and is now at the same level as 2Q2009.

Not the happiest of economic times

Brazil went from strong single-digit growth as recently as five years ago to a deep 2-

year economic recession that brought the GDP level to that of 4Q2010 with a

cumulative decline in per capital real GDP of 9.0%. The sharp deterioration in

economic performance reflects a combination of domestic and external factors. The

external backdrop turned less friendly: commodity prices declined, which resulted in

a deterioration in Brazil’s terms of trade, and global liquidity conditions became more

exigent. But the main driver of the sharp deterioration in the economy was the

heterodox/interventionist domestic policy mix, which ended up creating a number of

large imbalances. Expansionary fiscal and credit policies led to a meaningful decline

Exhibit 15: Severe Domestic Demand Retrenchment Exhibit 16: Deep and Prolonged Contraction of Gross Fixed

Investment

Source: Haver Analytics, Goldman Sachs Global Investment Research Source: Haver Analytics, Goldman Sachs Global Investment Research

Page 16

Goldman Sachs

in the savings rate of the economy and a deterioration in both the current account

and the fiscal balances. Rather than accelerating growth, the policy response ended

up incubating and accommodating inflationary pressures, and hurting the investment

outlook. This raised concerns about the policy approach, hurting consumer and

business sentiment, and deeply depressing the animal spirits in the economy.

B

razil is currently going through the early stages of a complex political transition

(which would need to be confirmed, or reversed, by a final Senate floor

impeachment vote likely in late August/early September). Given the economic

performance of recent years and unsettled political backdrop, markets have invested

a significant amount of hope in this transition, sustained by the expectation that it

could lead to a macro policy regime-shift, and a more stable and cooperative political

equilibrium. Part of the Brazilian financial markets’ positive performance in recent

months was admittedly driven by expectations that a new administration could: (1)

be more inclined to embrace the measures and structural reforms needed to

rebalance the economy and address the rapidly deteriorating fiscal picture, and (2)

prove capable of co-opting Congress and building the necessary political consensus

to move forward with the critically needed fiscal and structural reform agenda.

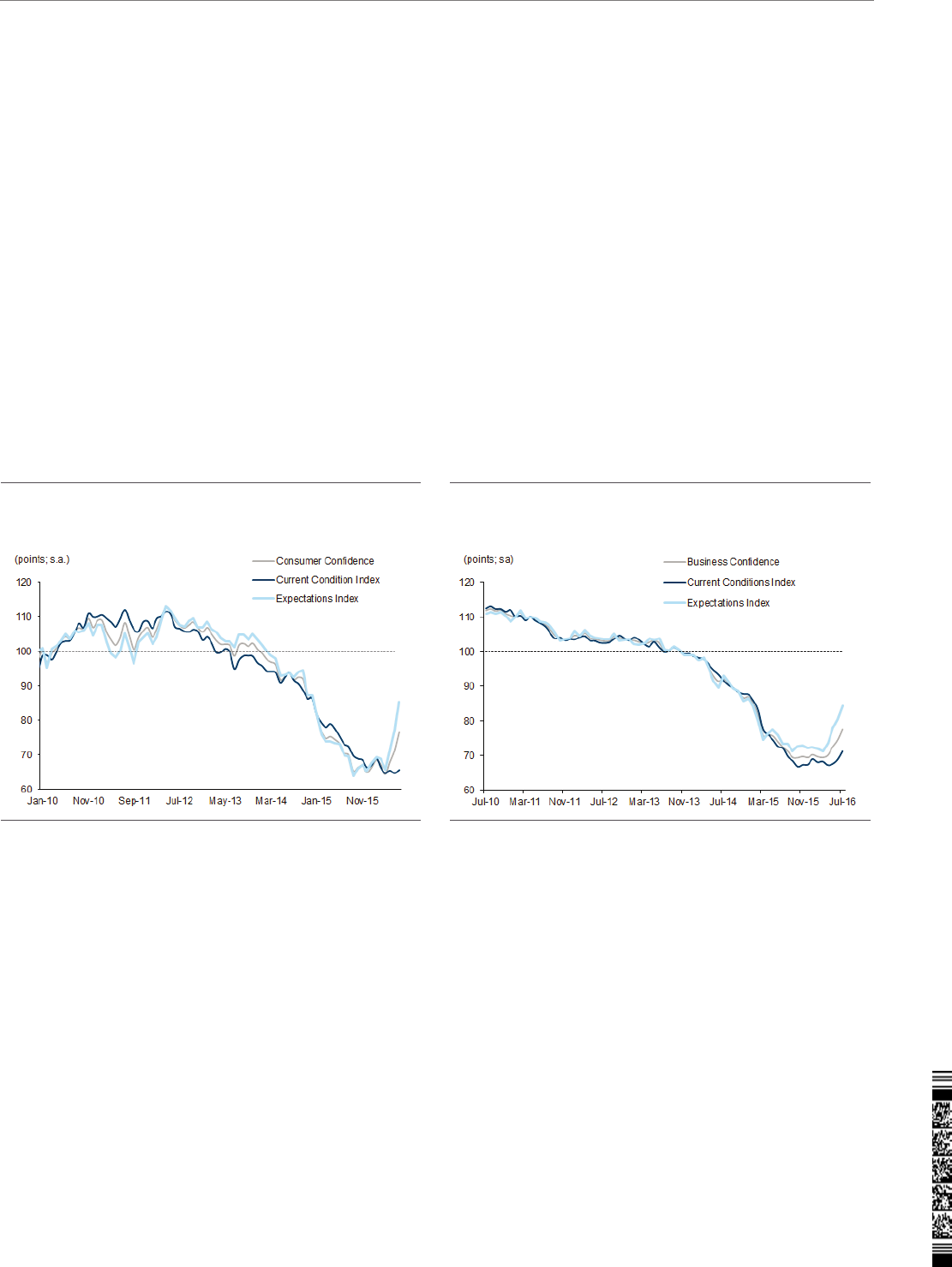

Note: Equal-weighted aggregate of retail, services, construction and industrial confidence indices.

There are now budding signs that the recessionary forces that have gripped the

economy are easing at the margin. Consumer and business confidence indicators

seem to have turned the corner and have started to improve in recent months, albeit

modestly and from extremely depressed levels. This could be a prelude to the end of

the recession and better days ahead, particularly if the recovery in sentiment is

supported and hauled up by tangible measures to deepen the needed fiscal

adjustment and rebalance the economy. In all, as the country welcomes thousands

of athletes and visitors and cheers the local favorites, it silently hopes that the

soaring Olympic spirit will also help lift the animal spirits of the Brazilian economy

and bring it back to the podium reserved for the top performers.

Alberto Ramos

Exhibit 17: Weak but Firming Consumer Confidence Exhibit 18: Business Confidence Rebounding from Record Lows

Note: Equal-weighted aggregate of retail, services, construction and

industrial confidence indices.

Source: FGV Source: FGV

Page 17

Goldman Sachs

Disclosure Appendix

Reg AC

We, Francesco Garzarelli, Kamakshya Trivedi, Alberto Ramos and Mark Ozerov, hereby certify that all of the views expressed in this report accurately

reflect our personal views, which have not been influenced by considerations of the firm’s business or client relationships.

Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Goldman Sachs’ Global Investment Research division.

Disclosures

Global product; distributing entities

The Global Investment Research Division of Goldman Sachs produces and distributes research products for clients of Goldman Sachs on a global basis.

Analysts based in Goldman Sachs offices around the world produce equity research on industries and companies, and research on macroeconomics,

currencies, commodities and portfolio strategy. This research is disseminated in Australia by Goldman Sachs Australia Pty Ltd (ABN 21 006 797 897); in

Brazil by Goldman Sachs do Brasil Corretora de Títulos e Valores Mobiliários S.A.; in Canada by either Goldman Sachs Canada Inc. or Goldman, Sachs &

Co.; in Hong Kong by Goldman Sachs (Asia) L.L.C.; in India by Goldman Sachs (India) Securities Private Ltd.; in Japan by Goldman Sachs Japan Co.,

L

td.; in the Republic of Korea by Goldman Sachs (Asia) L.L.C., Seoul Branch; in New Zealand by Goldman Sachs New Zealand Limited; in Russia by

O

OO Goldman Sachs; in Singapore by Goldman Sachs (Singapore) Pte. (Company Number: 198602165W); and in the United States of America by

G

oldman, Sachs & Co. Goldman Sachs International has approved this research in connection with its distribution in the United Kingdom and European

Union.

European Union: Goldman Sachs International authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and

the Prudential Regulation Authority, has approved this research in connection with its distribution in the European Union and United Kingdom; Goldman

Sachs AG and Goldman Sachs International Zweigniederlassung Frankfurt, regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht, may also

distribute research in Germany.

General disclosures

This research is for our clients only. Other than disclosures relating to Goldman Sachs, this research is based on current public information that we

consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and

forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as

appropriate, but various regulations may prevent us from doing so. Other than certain industry reports published on a periodic basis, the large majority

of reports are published at irregular intervals as appropriate in the analyst’s judgment.

Goldman Sachs conducts a global full-service, integrated investment banking, investment management, and brokerage business. We have investment

banking and other business relationships with a substantial percentage of the companies covered by our Global Investment Research Division.

Goldman, Sachs & Co., the United States broker dealer, is a member of SIPC (http://www.sipc.org

).

Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients and principal

trading desks that reflect opinions that are contrary to the opinions expressed in this research. Our asset management area, principal trading desks and

investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research.

The analysts named in this report may have from time to time discussed with our clients, including Goldman Sachs salespersons and traders, or may

discuss in this report, trading strategies that reference catalysts or events that may have a near-term impact on the market price of the equity securities

discussed in this report, which impact may be directionally counter to the analyst’s published price target expectations for such stocks. Any such

trading strategies are distinct from and do not affect the analyst’s fundamental equity rating for such stocks, which rating reflects a stock’s return

potential relative to its coverage group as described herein.

We and our affiliates, officers, directors, and employees, excluding equity and credit analysts, will from time to time have long or short positions in, act

as principal in, and buy or sell, the securities or derivatives, if any, referred to in this research.

The views attributed to third party presenters at Goldman Sachs arranged conferences, including individuals from other parts of Goldman Sachs, do not

necessarily reflect those of Global Investment Research and are not an official view of Goldman Sachs.

Any third party referenced herein, including any salespeople, traders and other professionals or members of their household, may have positions in the

products mentioned that are inconsistent with the views expressed by analysts named in this report.

This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be

illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of

individual clients. Clients should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, if

appropriate, seek professional advice, including tax advice. The price and value of investments referred to in this research and the income from them

may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.

Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments.

Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors.

Investors should review current options disclosure documents which are available from Goldman Sachs sales representatives or at

http://www.theocc.com/about/publications/character-risks.jsp

. Transaction costs may be significant in option strategies calling for multiple purchase and

sales of options such as spreads. Supporting documentation will be supplied upon request.

All research reports are disseminated and available to all clients simultaneously through electronic publication to our internal client websites. Not all

research content is redistributed to our clients or available to third-party aggregators, nor is Goldman Sachs responsible for the redistribution of our

research by third party aggregators. For research, models or other data available on a particular security, please contact your sales representative or go

to http://360.gs.com

.

Disclosure information is also available at http://www.gs.com/research/hedge.html

or from Research Compliance, 200 West Street, New York, NY

10282.

© 2016 Goldman Sachs.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written

consent of The Goldman Sachs Group, Inc.

29 July 2016 Page 18

Goldman Sachs

The Olympics and Economics 2016